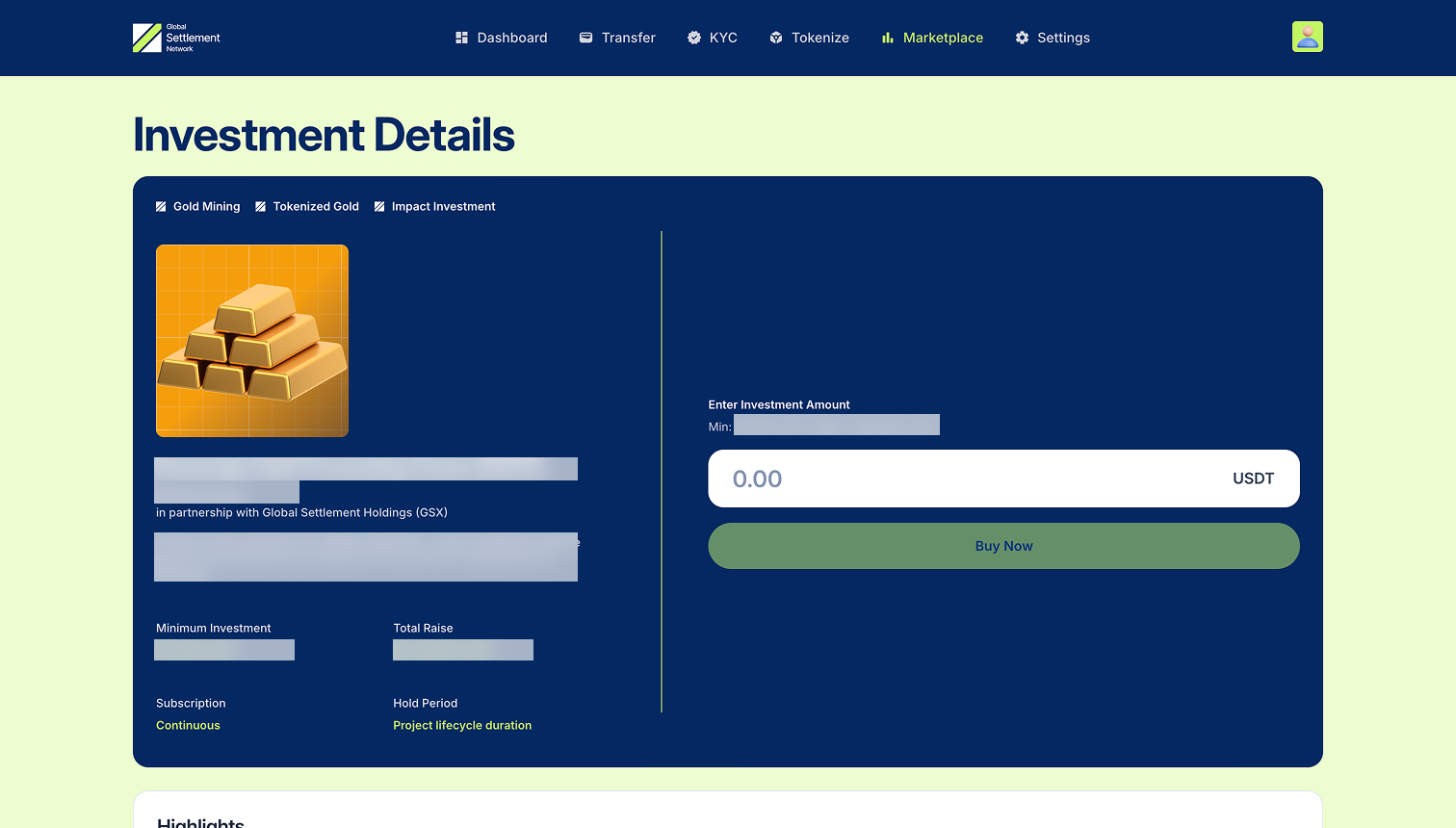

Featured Case Study

Tokenized energy acquisition

A $75M Latin American oil & gas facility acquisition structured with tokenized debt and equity

Overview

Coverage described a $75M Latin American oil & gas facility acquisition structured with tokenized debt and equity, settled using stablecoins, with settlement time reduced from days to minutes.

Key Highlights

Tokenized debt and equity structure

Press-backed coverage of innovative capital structure

Settlement time: Days to minutes

Dramatic reduction in settlement friction using stablecoins

Energy infrastructure focus

Latin American oil & gas facility acquisition

Request the full case study

Get detailed insights into the tokenization structure, settlement process, and financial engineering details.

DEAL SIZE

$75M

Acquisition Value

SETTLEMENT TIME

Minutes

vs Days Previously

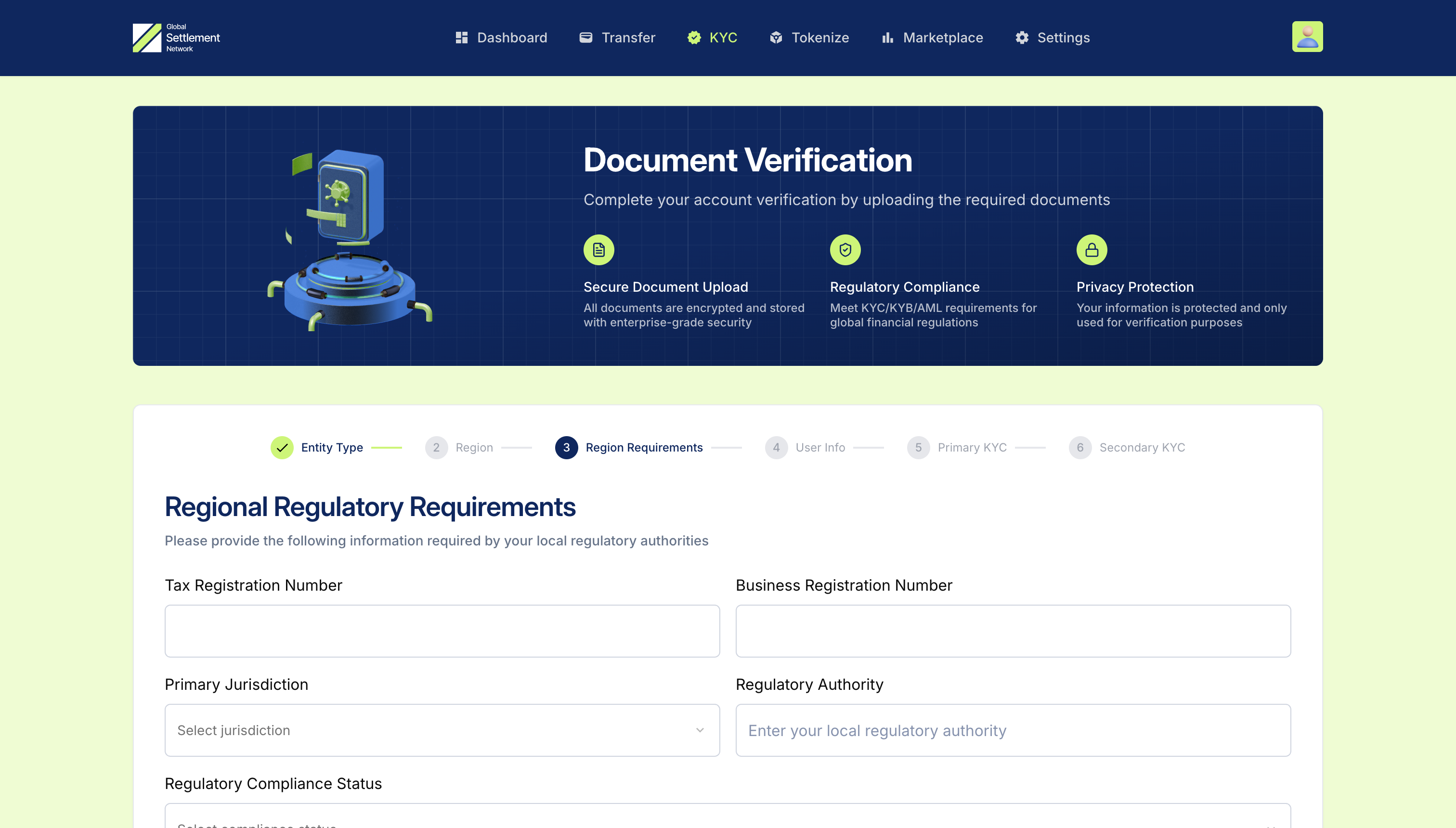

Built for production, not pilots.

Enterprise-grade tools for asset tokenization, distribution, and lifecycle management at scale.

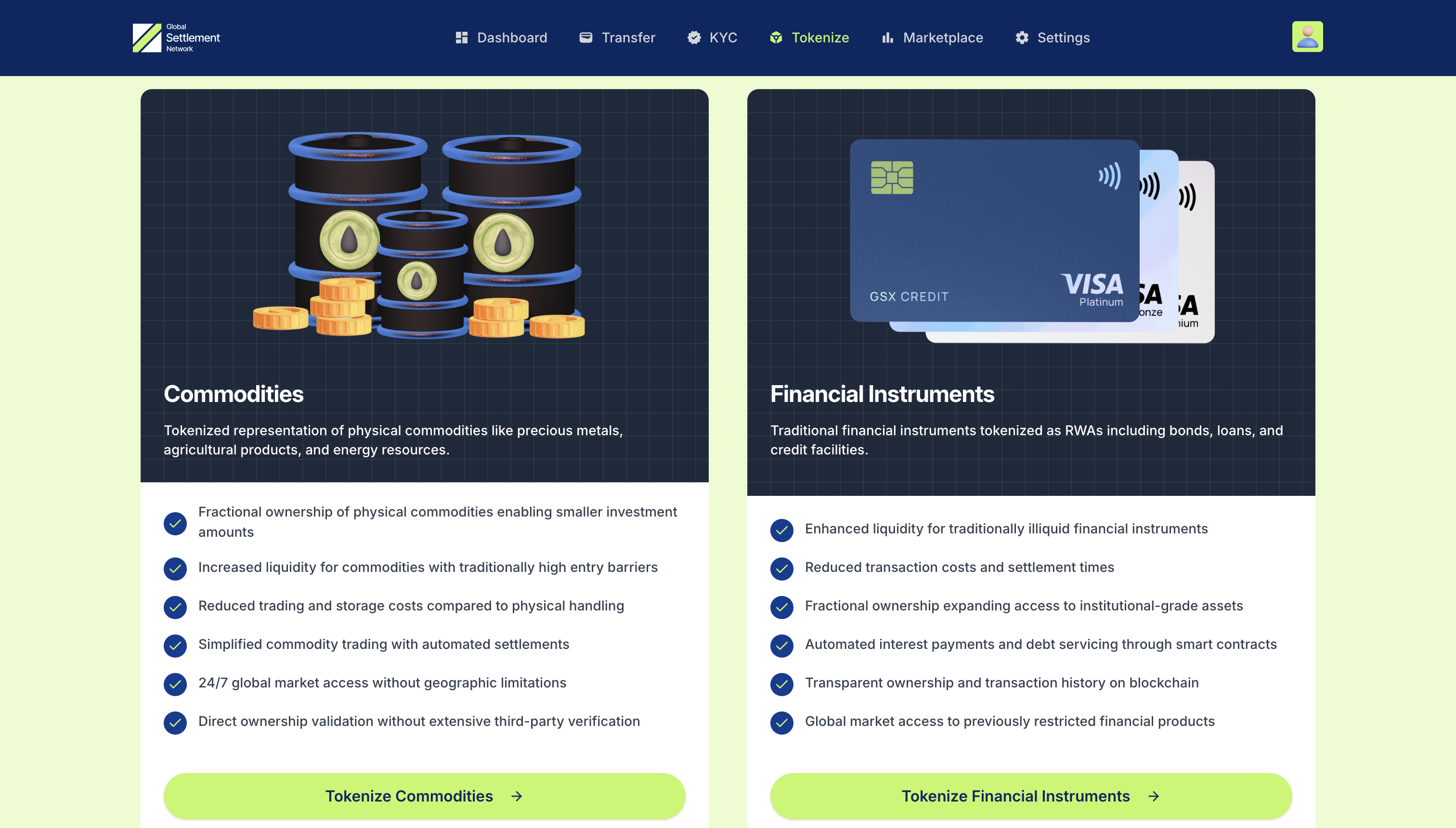

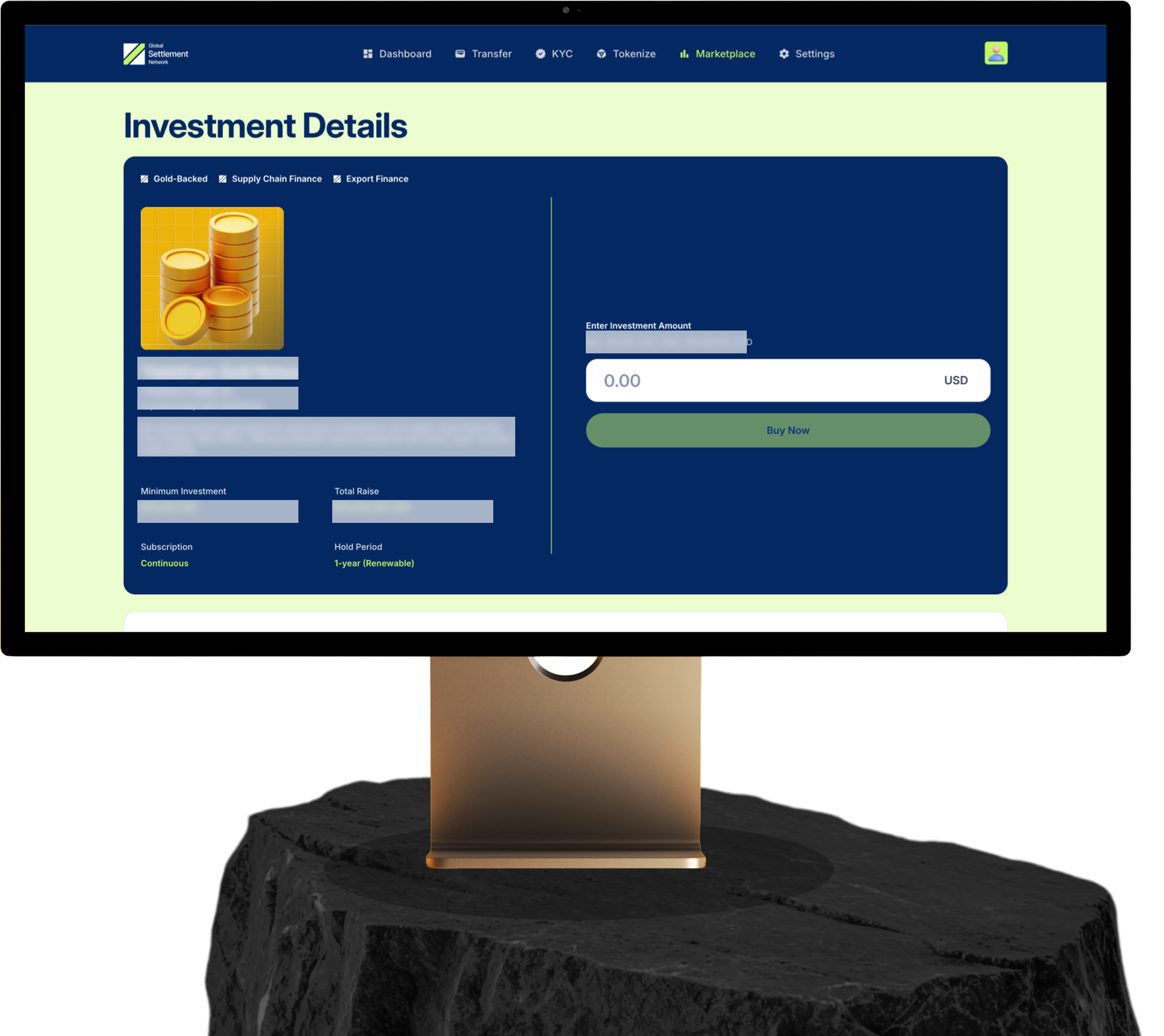

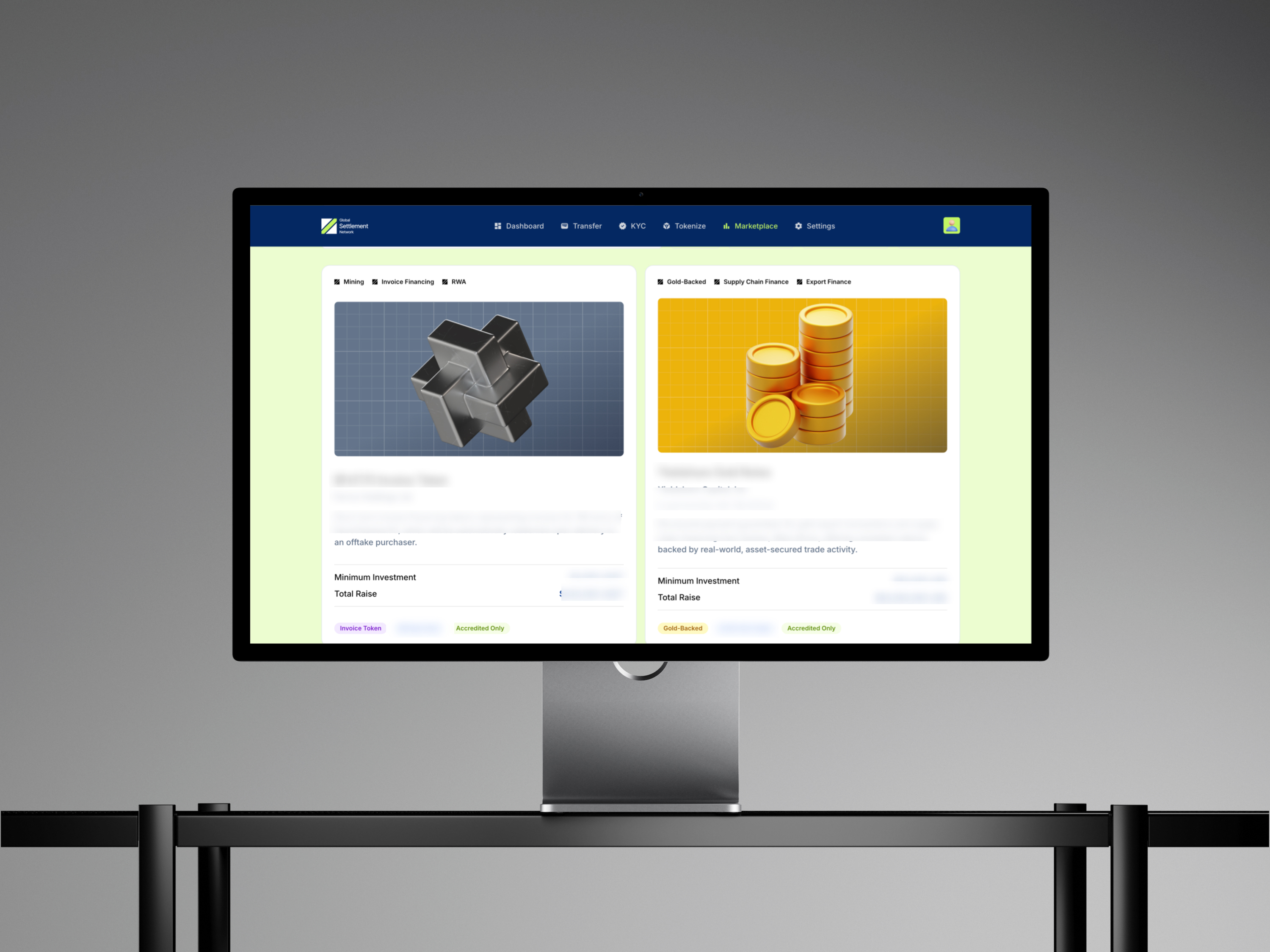

Tokenize any asset class

Enterprise-grade infrastructure for real-world asset tokenization

Commodities

Gold, silver, oil, agricultural products, and carbon credits.

Physical backing verification

Custody integration

Delivery mechanisms

Real Estate

Commercial, residential, and REITs with fractional ownership.

Title registry integration

Rental income distribution

Secondary market liquidity

Securities

Bonds, equities, and structured products with instant settlement.

Cap table management

Dividend automation

Reg D/S compliance

Private Credit

Loans, receivables, and invoice financing with automated servicing.

Payment waterfall logic

Default handling

Credit scoring integration

Energy Assets

Renewable energy credits, carbon offsets, and power purchase agreements.

MRV data integration

Registry compliance

Retirement tracking

AI Compute

GPU time, training runs, and inference credits as tradeable assets.

Usage metering

Dynamic pricing

Capacity reservations

Tokenization Lifecycle

From structuring to operations

Structuring

Asset analysis, legal structuring, and SPV setup

Token Design

Smart contract design, compliance rules, and token economics

Issuance

Mint tokens with KYC/AML verification and regulatory docs

Liquidity

Primary distribution, secondary markets, and market making

Interop

Cross-chain bridges, settlement rails, and partner integrations

Operations

Corporate actions, servicing, reporting, and redemption

Structuring

Asset analysis, legal structuring, and SPV setup

Token Design

Smart contract design, compliance rules, and token economics

Issuance

Mint tokens with KYC/AML verification and regulatory docs

Liquidity

Primary distribution, secondary markets, and market making

Interop

Cross-chain bridges, settlement rails, and partner integrations

Operations

Corporate actions, servicing, reporting, and redemption

INSTITUTIONAL GRADE

Built for regulated markets

Navigate complex securities regulations with built-in compliance frameworks and automated reporting.

Transfer Agent Integration: Seamless connection with existing infrastructure

Accredited Investor Verification: Automated status checks and ongoing monitoring

Multi-Jurisdiction Support: US, EU, APAC regulatory frameworks

Ready to bring your assets on-chain?

Whether you're an issuer looking to tokenize assets or a broker seeking distribution infrastructure, we'll help you get started.