CBDC STUDIO

Sovereign digital currency infrastructure for central banks

Deploy wholesale and retail CBDCs with programmable monetary policy, privacy controls, and interoperability. Built for government-grade security and scale.

Built for central banks and monetary authorities.

Production-grade tools for managing sovereign digital currency with full policy control, privacy, and interoperability.

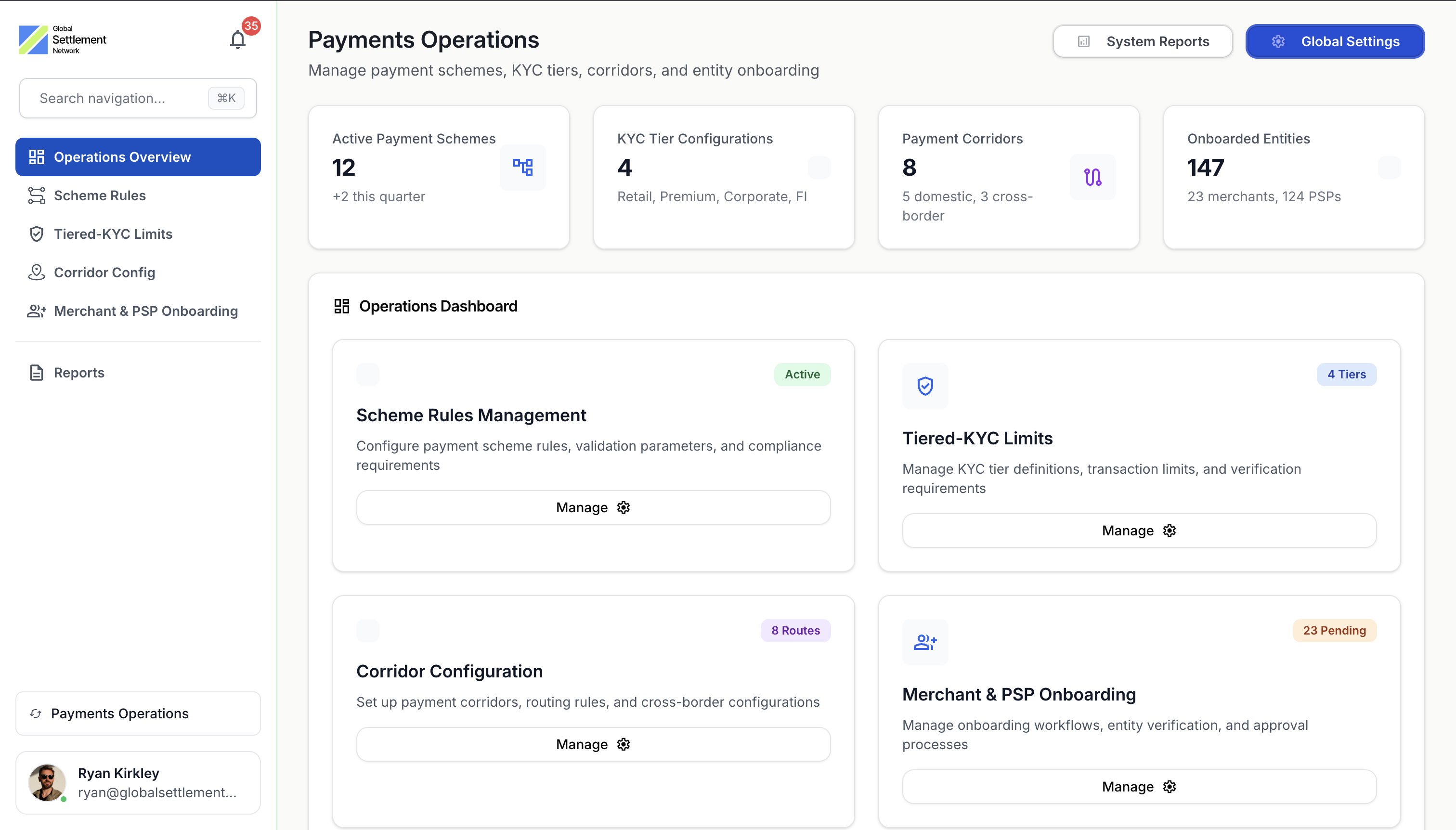

Two-tier architecture

Support both wholesale and retail use cases on a unified platform

Wholesale CBDC

Cross-border settlement corridors

Securities settlement integration

FX swap automation

Retail CBDC

Privacy-preserving transactions

Offline payment support

Tiered wallet limits

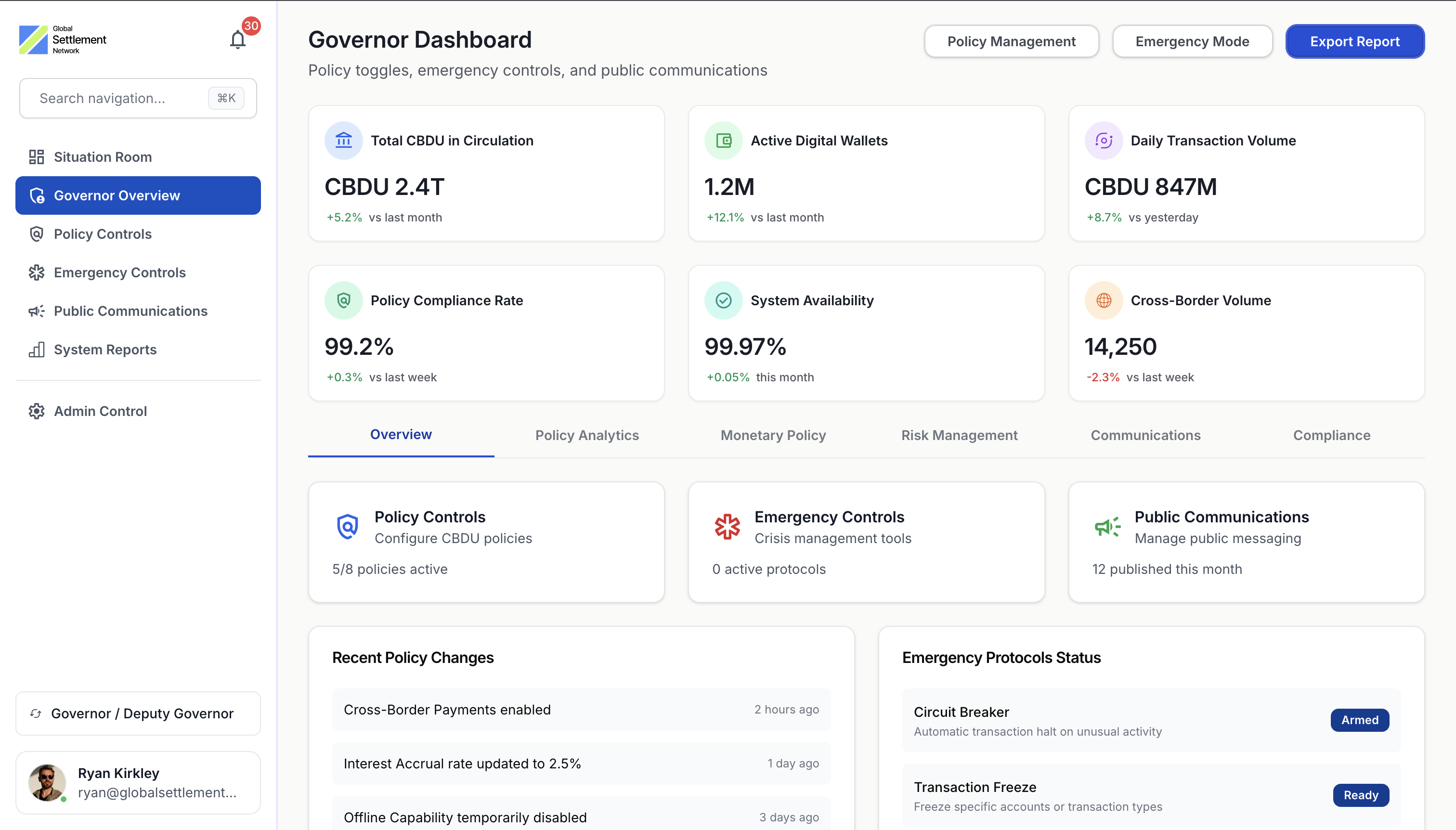

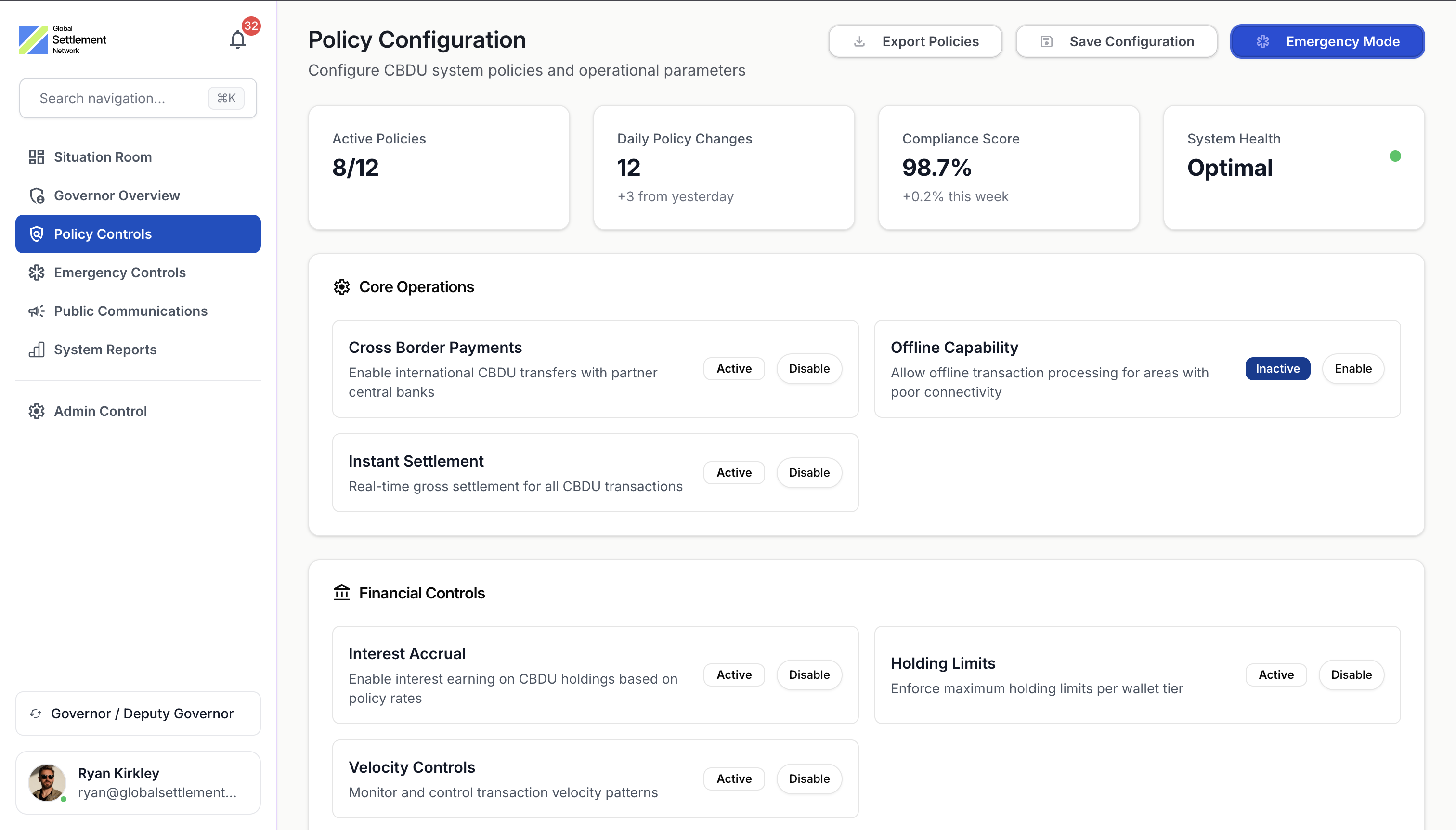

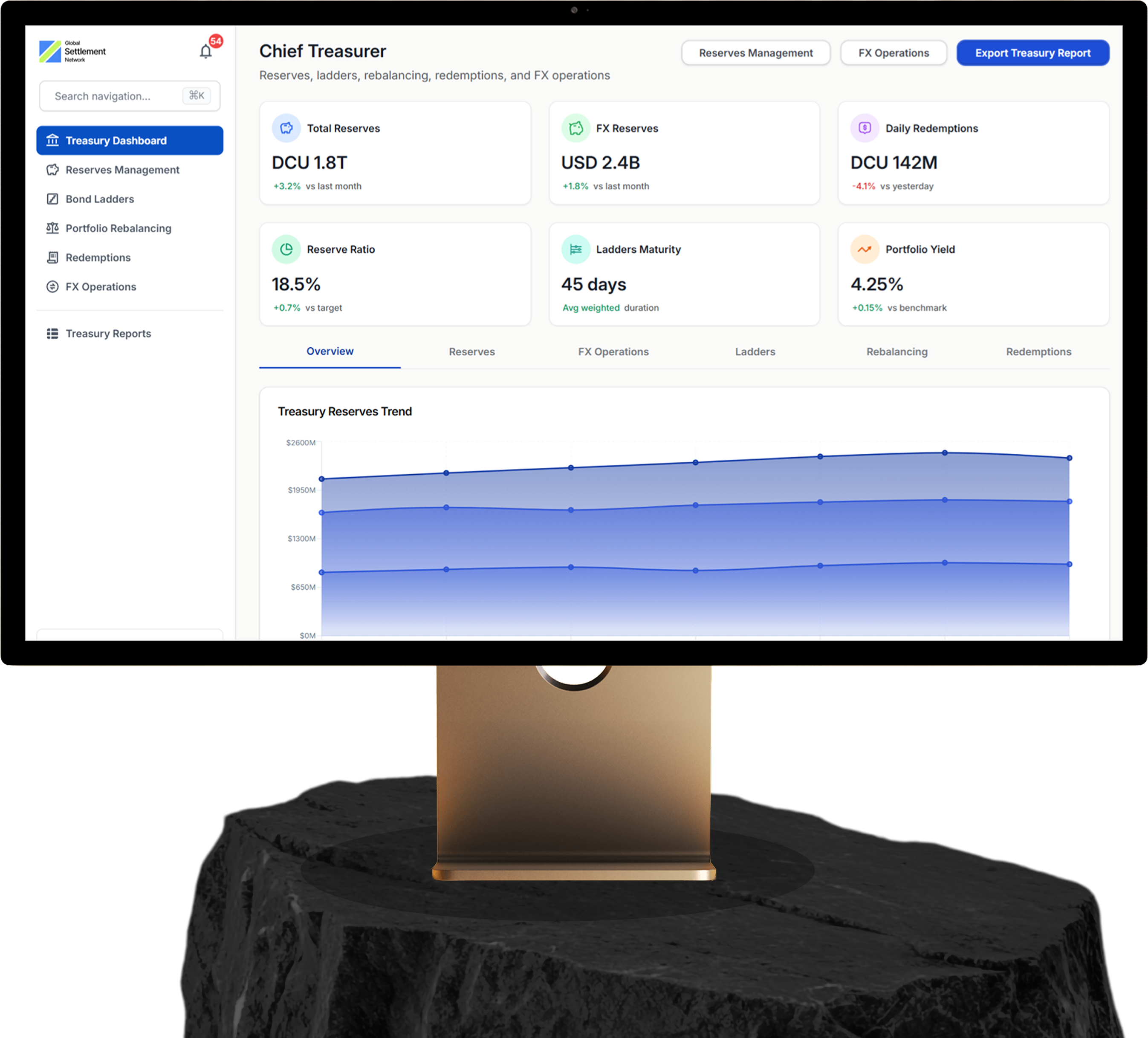

POLICY CONTROLS

Programmable monetary policy engine

Maintain monetary sovereignty with fine-tuned control over interest rates, distribution, compliance, and cross-border interoperability.

Interest Rate Controls: Programmable interest rates, velocity controls, and targeted stimulus distribution

Distribution Models: Direct, intermediated, or hybrid distribution through commercial banks

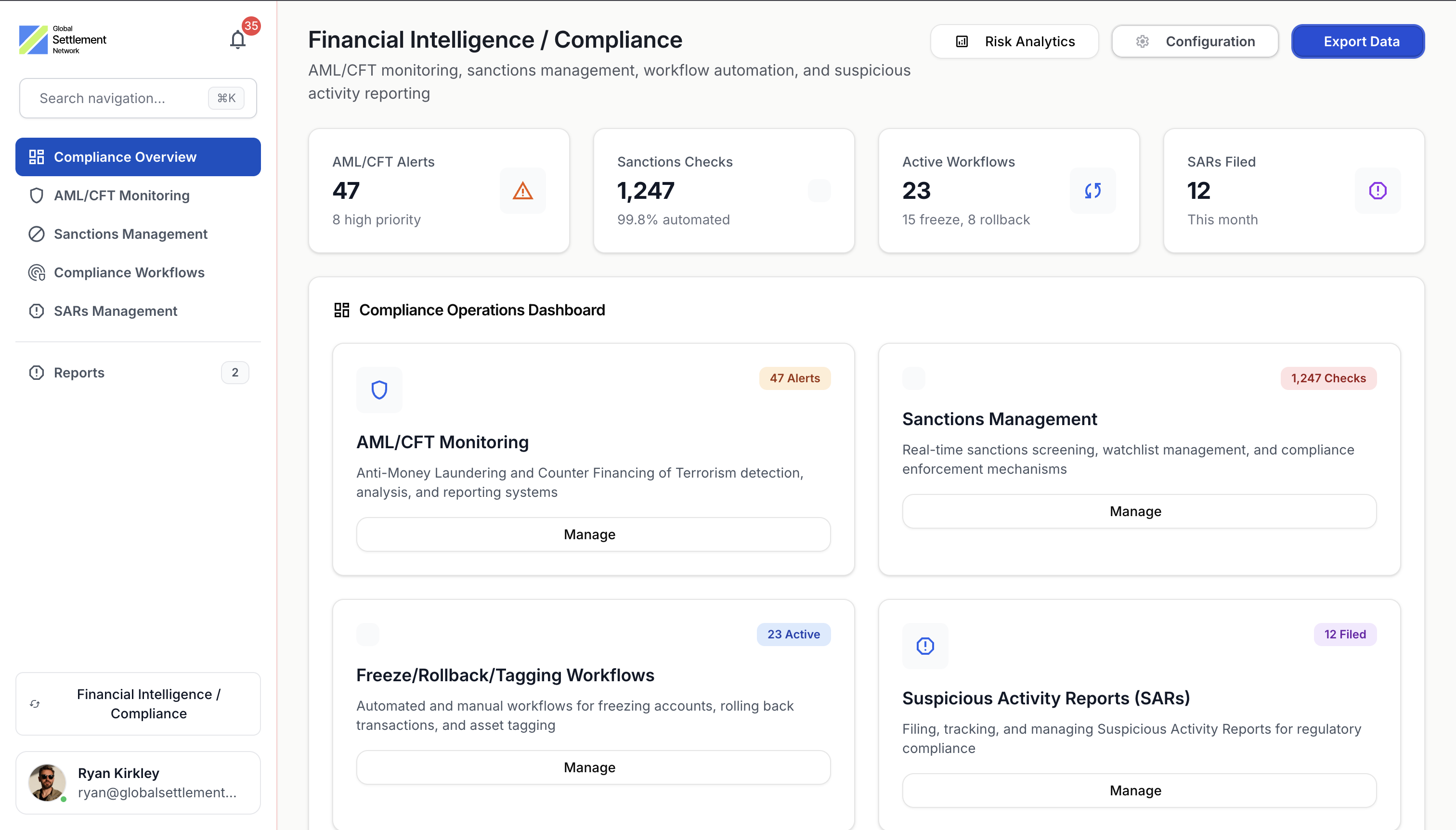

Compliance Controls: AML/CFT rules, sanctions screening, and programmable spending restrictions

Cross-Border Rails: Native interoperability with foreign CBDCs and settlement networks

PRIVACY CONTROLS

Configurable privacy architecture

Balance user privacy with regulatory compliance through advanced cryptographic techniques and configurable disclosure rules.

Selective Disclosure: Users reveal only the minimum information required for each transaction

Zero-Knowledge Proofs: Verify transaction validity without exposing underlying data

Configurable Anonymity Sets: Adjustable privacy levels to meet jurisdictional requirements

QUANTUM PROOF

Post-quantum cryptography, built in

Future-proof your sovereign digital currency against quantum computing threats with NIST-standardized algorithms and crypto-agile architecture.

Lattice-Based Encryption

CRYSTALS-Kyber for key encapsulation and CRYSTALS-Dilithium for digital signatures, providing NIST-standardized post-quantum security.

Hybrid Key Exchange

Combines classical and post-quantum key exchange mechanisms for defense-in-depth during the transition period.

Crypto-Agile Architecture

Swappable cryptographic primitives allow rapid algorithm updates without disrupting live currency operations.

GOVERNMENT-GRADE SECURITY

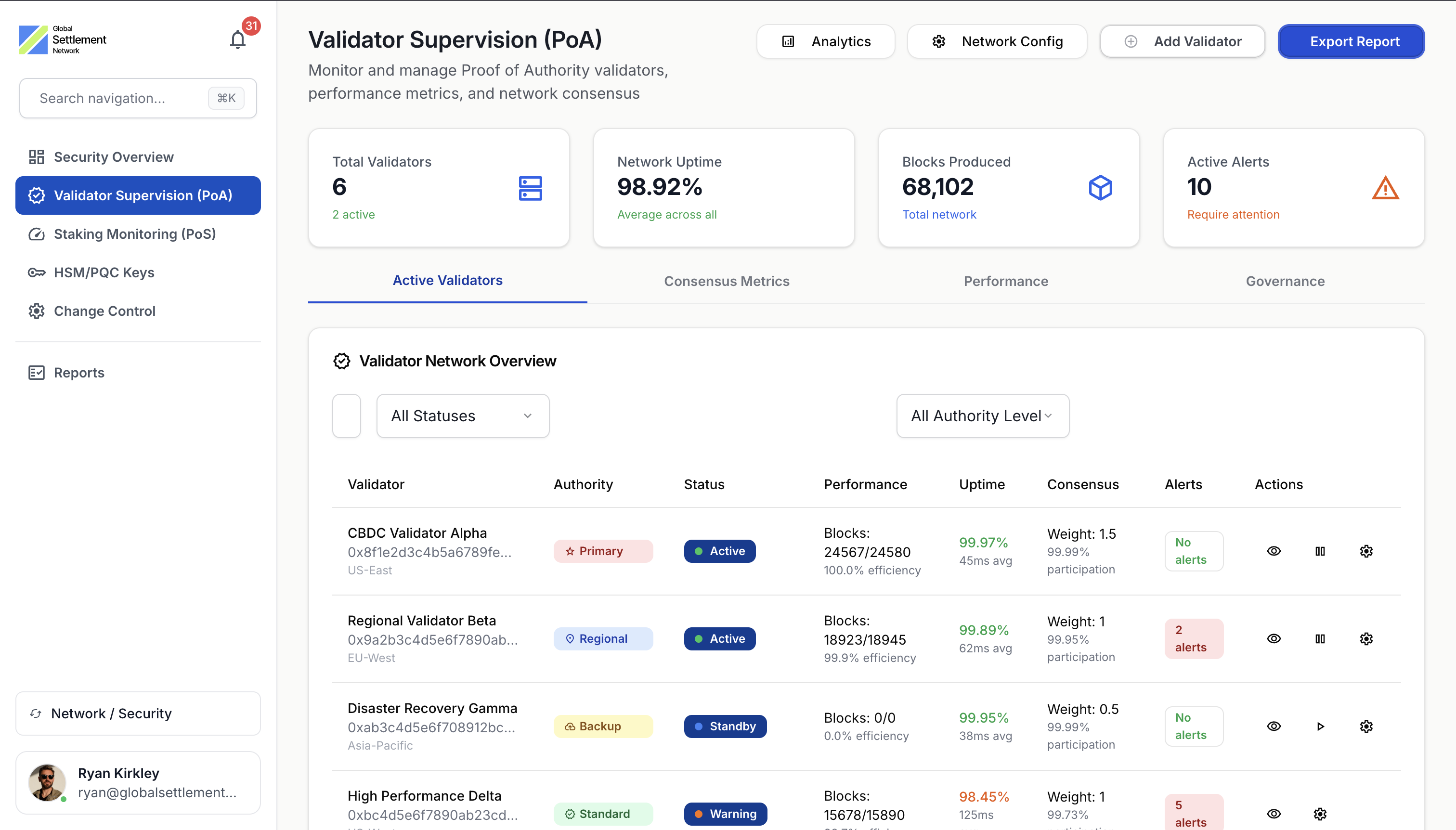

Built to central bank standards

Meet the highest requirements for security, availability, and operational resilience.

Air-gapped Operations: Critical systems isolated from public networks

High Availability: Designed for continuous uptime with active-active failover

Resilient Infrastructure: Multi-region deployment, Byzantine fault tolerance, and disaster recovery

Explore CBDC infrastructure for your jurisdiction

Connect with our policy and technical teams to discuss your central bank digital currency requirements.