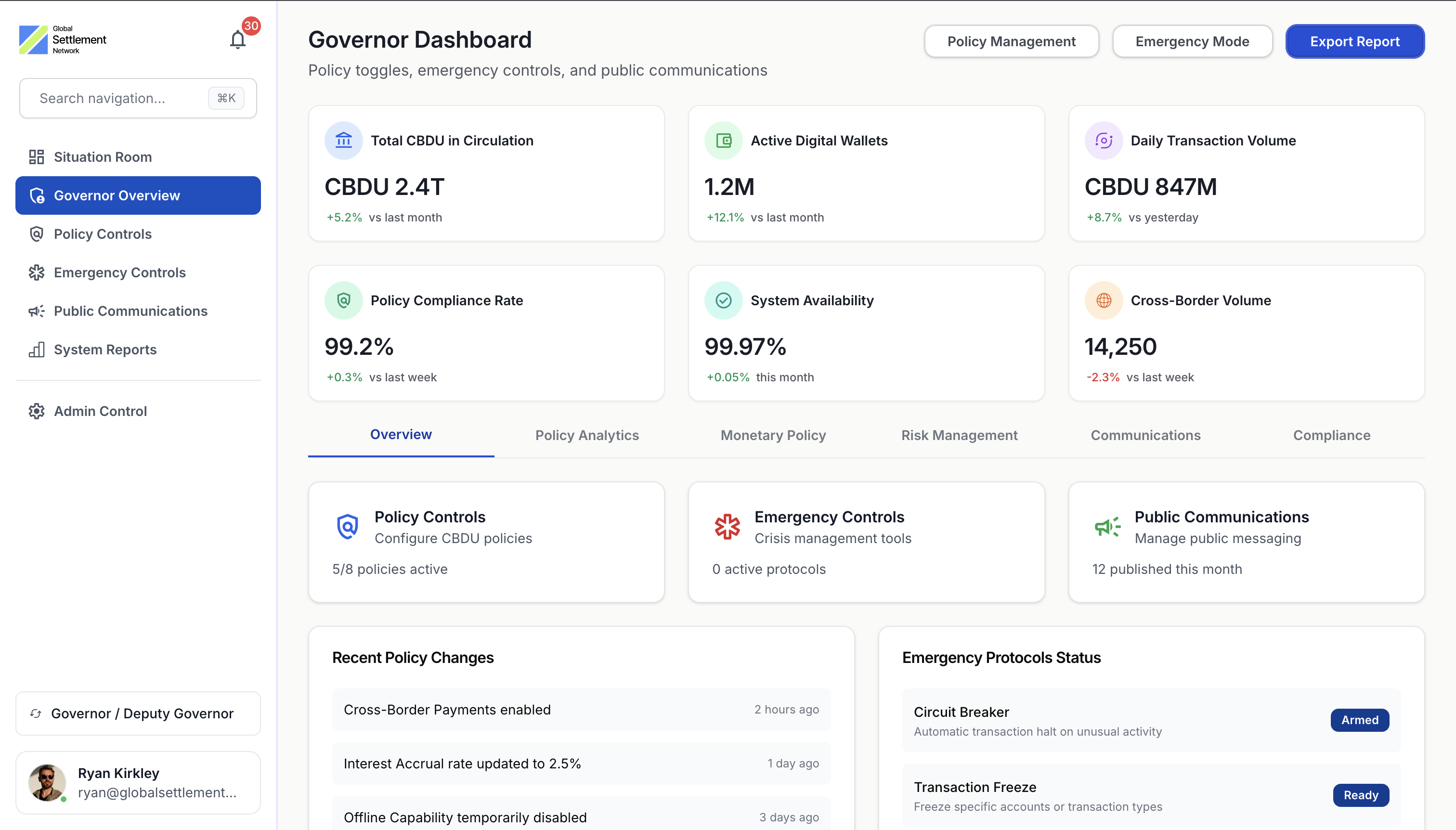

Sovereign digital currency infrastructure

Deploy CBDCs, modernize payment rails, and maintain monetary sovereignty while enabling seamless cross-border settlement.

Featured Case Study

Uganda digital infrastructure and CBDC rails

A $5.5B digital infrastructure initiative with pilot digital shilling CBDC backed by treasury bonds

Overview

Reporting describes a plan centered on a $5.5B digital infrastructure initiative, including a pilot "digital shilling" CBDC backed by treasury bonds and designed to reach citizens via USSD access paths.

Initial deployment focus: Karamoja region

Industrial smart city / SEZ approach

Target impact cited publicly

Over 1 million jobs and >$10B exports

USSD-based access

Designed for broad citizen reach via basic mobile phones

INFRASTRUCTURE

$5.5B

Investment

TARGET IMPACT

1M+

Jobs Created

Comprehensive government solutions

From policy design to technical deployment

MONETARY SOVEREIGNTY

Maintain control, gain capabilities

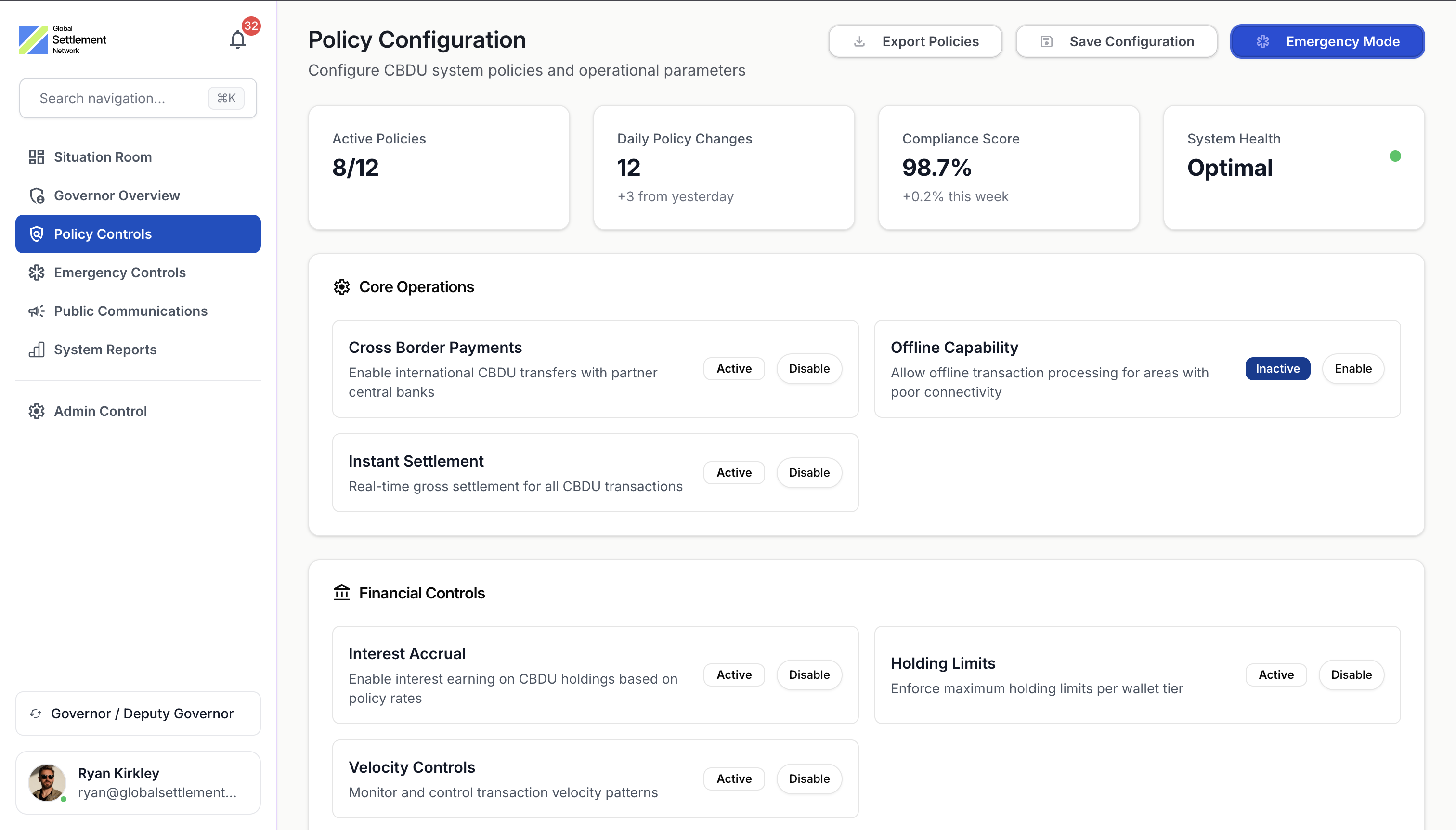

Deploy digital currency infrastructure without sacrificing monetary sovereignty or policy independence.

Full Policy Control: Programmable monetary policy with fine-tuned rules

Data Sovereignty: On-premise or sovereign cloud deployment options

Interoperability: Connect to global networks without dependency

Built for central banks and monetary authorities.

Production-grade tools for managing sovereign digital currency with full policy control, privacy, and interoperability.

CBDC deployment models

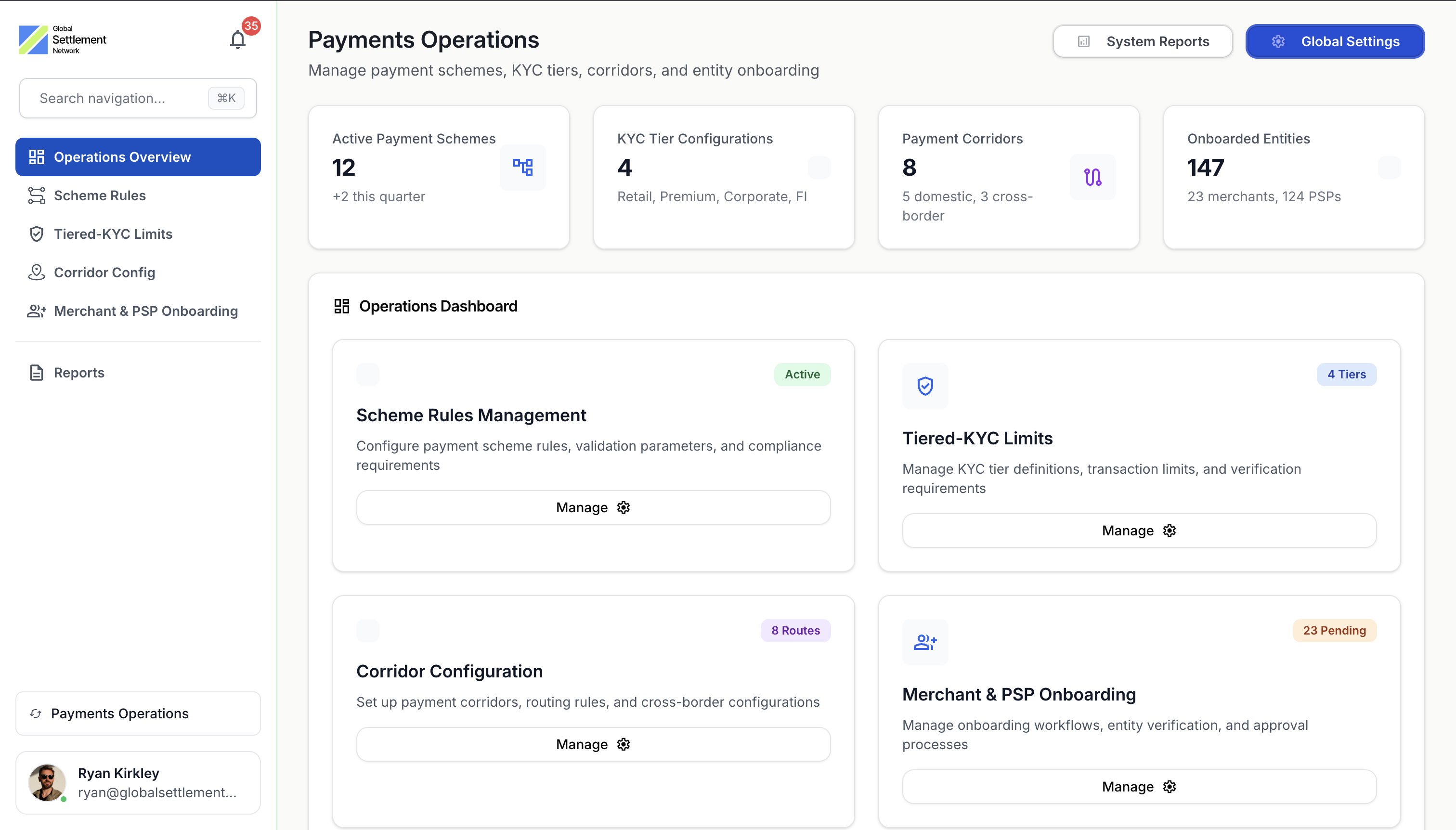

Flexible architectures for different policy objectives

Wholesale CBDC

For interbank settlement, securities DVP, and cross-border transactions. High-value, low-volume architecture.

View features

RTGS integration

Securities settlement

FX settlement corridors

Retail CBDC

For consumer payments and financial inclusion. High-volume, low-value with privacy features.

View features

Privacy-preserving

Offline payments

Tiered wallet limits

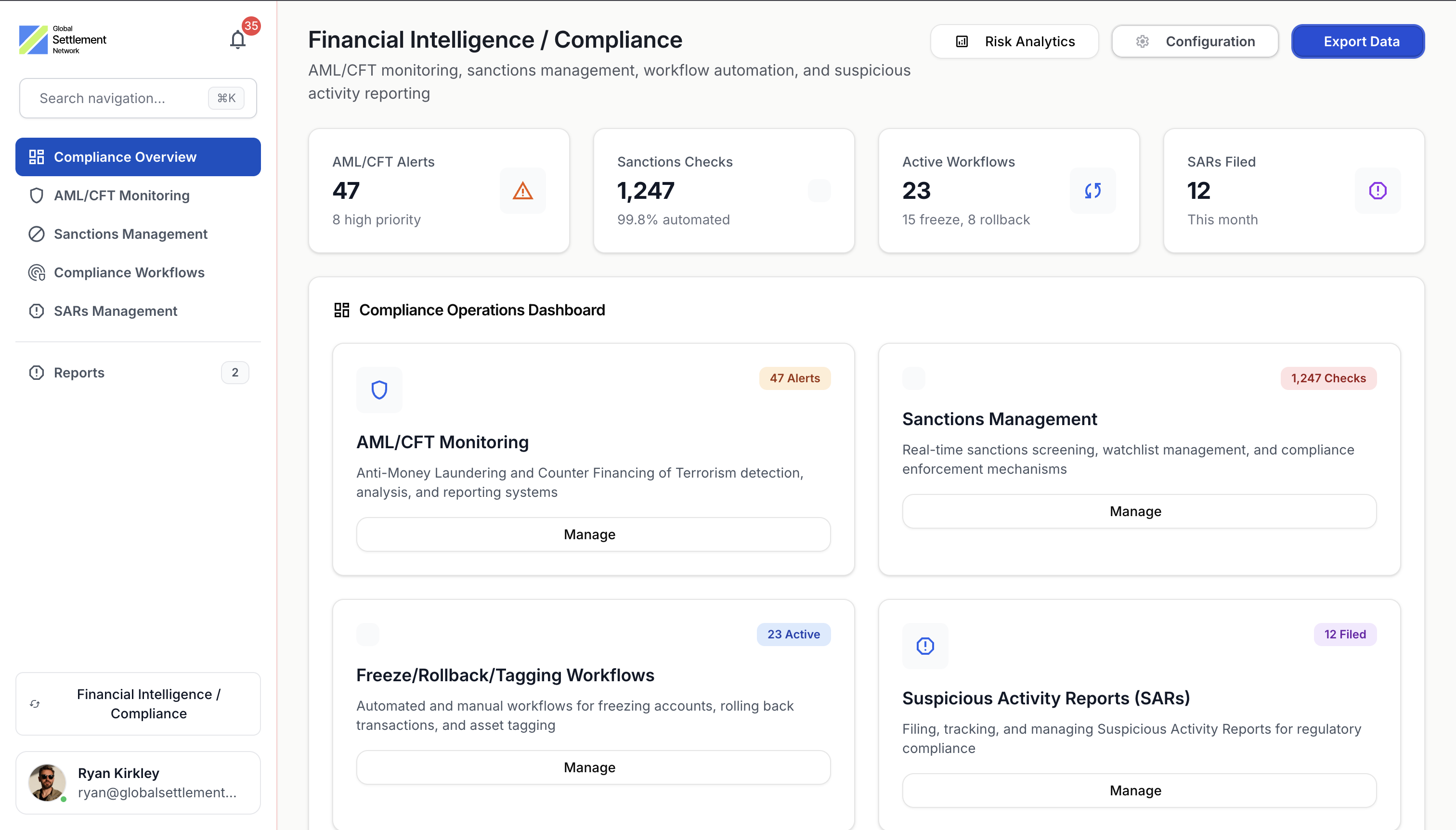

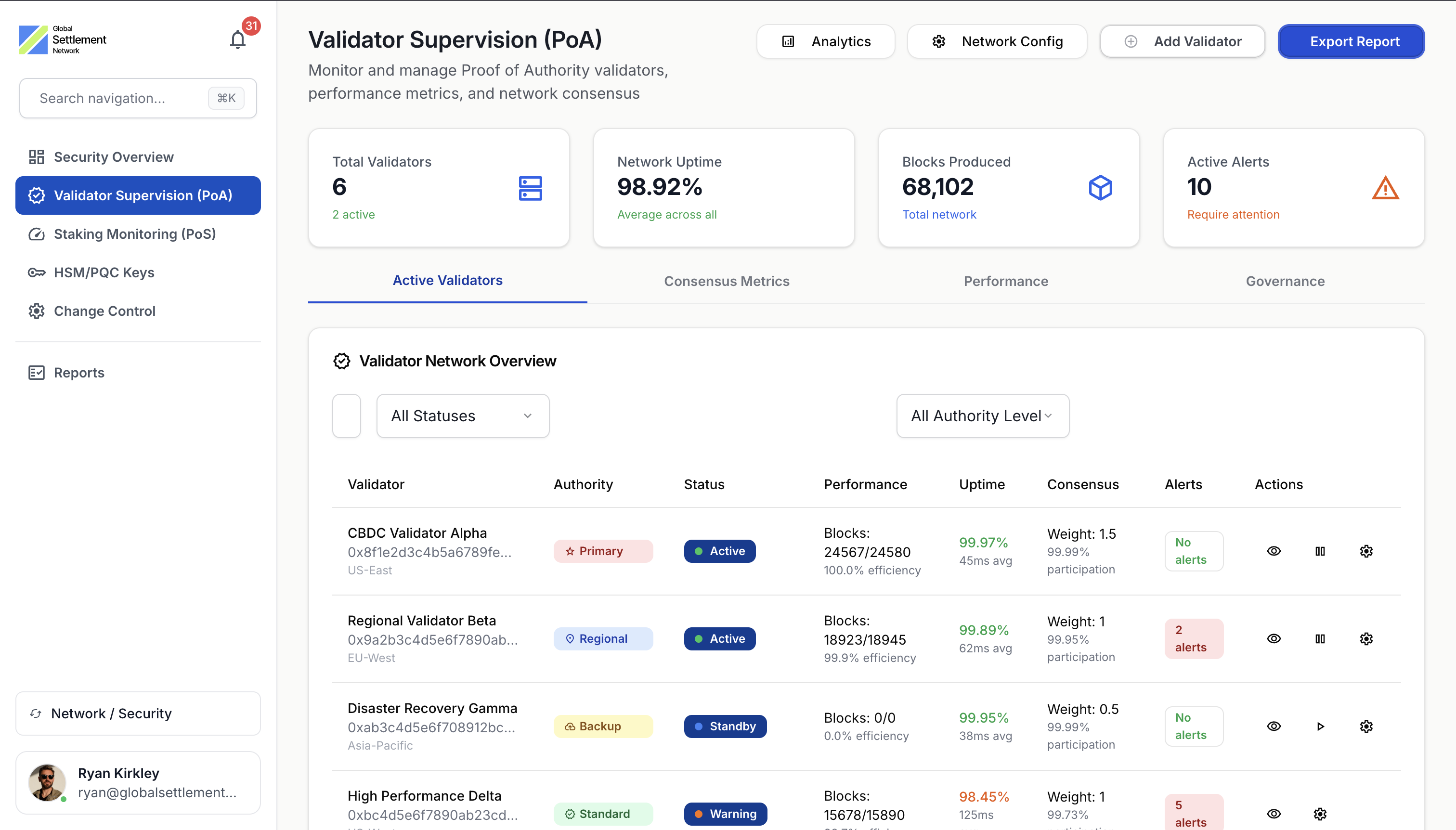

GOVERNMENT-GRADE SECURITY

Meets the highest security standards

Infrastructure designed for critical national payment systems with comprehensive security controls.

Air-Gapped Deployment: Option for completely isolated infrastructure

Quantum-Resistant: Post-quantum cryptography for long-term security

Disaster Recovery: Multi-region redundancy with automated failover