Enterprise-Grade Infrastructure

Public banking rails for the future of currency and settlement.for modern currency and settlement.

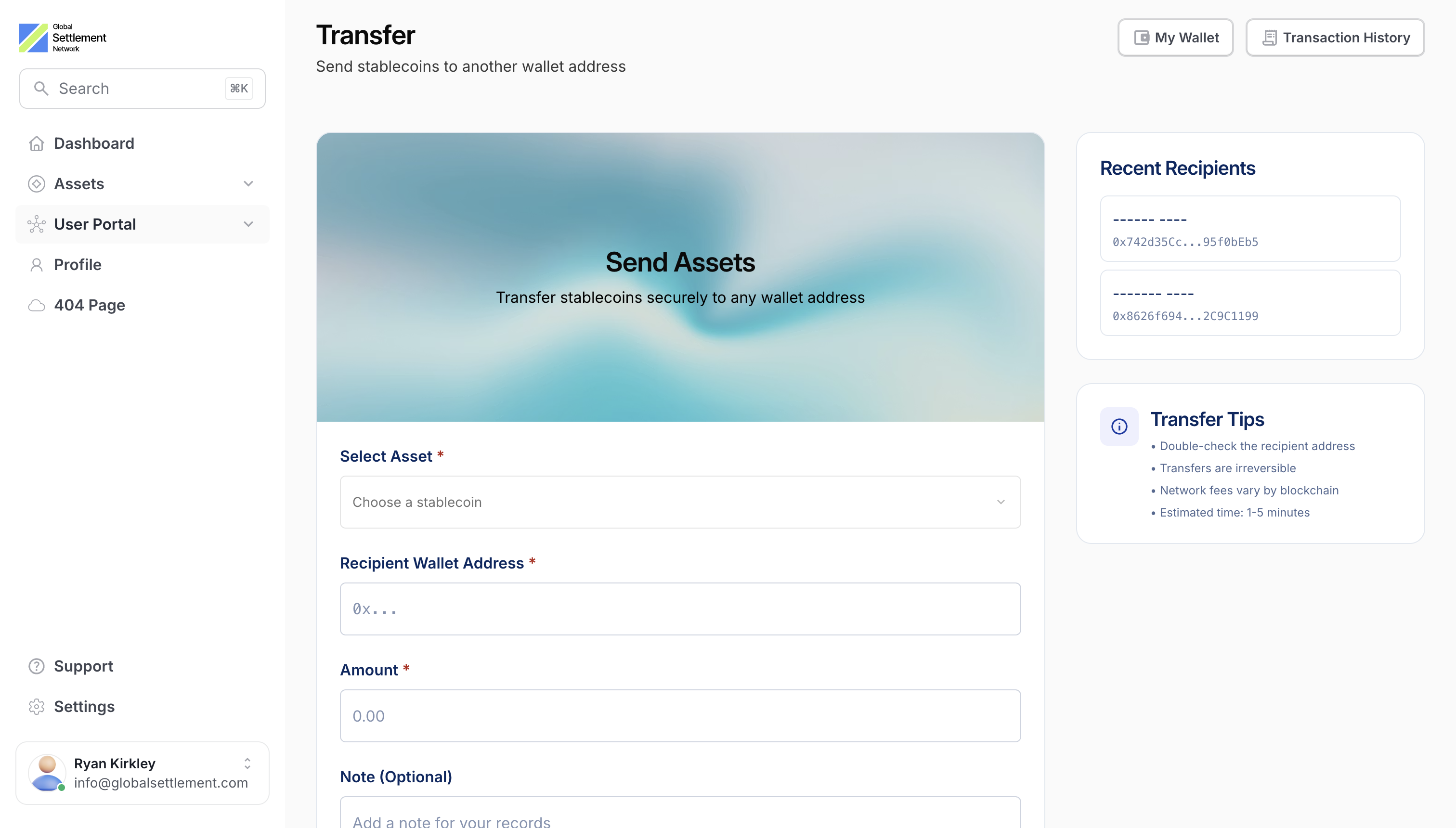

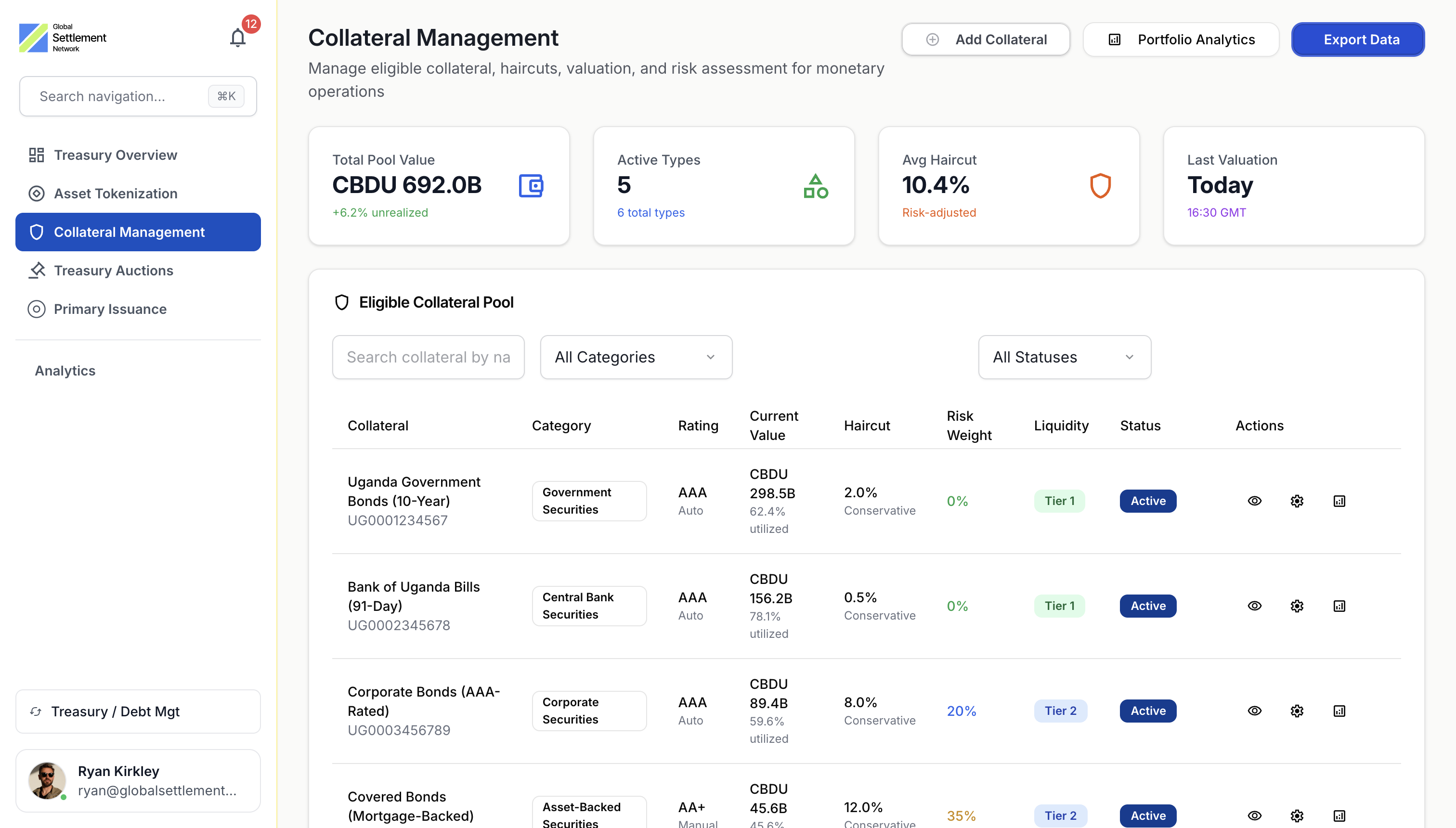

Global Settlement Network enables regulated institutions to issue digital currency, settle tokenized assets, and move value across borders with near-instant finality.

Trusted by 6+ banks & 3+ governments

Trusted by leading institutions

Powering the future of digital currency and settlement infrastructure

Global settlement.

Simplified.

Four steps to move value across borders instantly.

Powering global financial

infrastructure.

Trusted by leading institutions across banking, government, and digital asset ecosystems.

ACTIVE BANKS

Global financial institutions leveraging our network for instant cross-border settlement and liquidity.

GOVERNMENTS

National governments deploying CBDC infrastructure and sovereign digital currency systems.

PROTOCOLS

Blockchain protocols integrated for interoperable settlement, tokenized assets, and stablecoin rails.

OTC DESKS

Over-the-counter trading desks executing large-volume transactions with instant settlement finality.

Network counts reflect signed partnerships and active integrations as of January 2026. Contact us for more details.

Featured in

By replacing traditional rails like SWIFT with blockchain-based systems that work across chains and across asset classes, Global Settlement is offering an alternative that doesn't force users into the crypto weeds.

Designed to bring real-world infrastructure, renewable energy, and trade assets onto a blockchain-based system, the initiative is one of the biggest digital economy transformations in Africa, bringing about national-scale digital infrastructure.

Industry observers see this acquisition as a breakthrough moment for blockchain adoption in traditional sectors. The use of tokenized capital in live infrastructure deals signals growing confidence in blockchain as a financing tool for institutional-grade projects.

Our partnership with Global Settlement marks a new era for Uganda's industrial transformation

Global Settlement Network (GSX) and Ubuntu Tribe on Wednesday launched a gold-backed, on-chain settlement corridor, aiming to cut Africa–EU transfer times from weeks to seconds and bring over $5 billion of gold on-chain.

By integrating tokenization and CBDCs into Uganda's development roadmap, we're creating transparent, tech-driven ecosystems that attract new capital, empower local industries, and scale sustainable growth from the ground up.

Blockchain infrastructure firm Global Settlement Network has announced a pilot to tokenize water treatment sites in Jakarta, aiming to eventually scale it out to the rest of Southeast Asia over the next 12 months with $200 million in tokenized assets.