Settlement infrastructure for global banks

Reduce cross-border settlement times from days to seconds. Lower costs, reduce correspondent banking delays, and optimize treasury operations.

Built for operational teams, not just pilots.

Production-ready tools for treasury, compliance, and operations teams to manage stablecoin issuance and cross-border settlement.

Built for banking infrastructure

Enterprise-grade solutions for correspondent banking, treasury, and payments

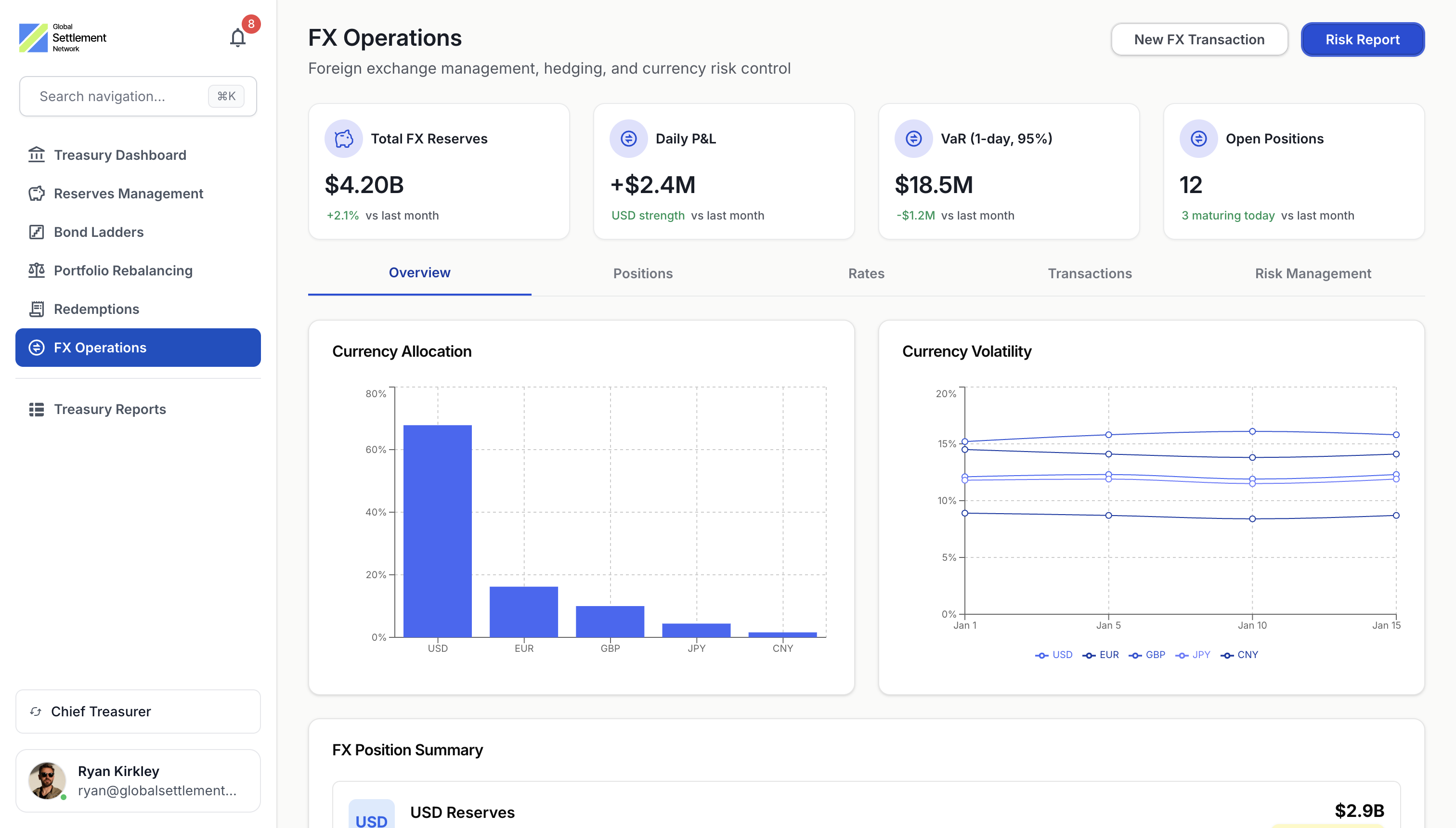

FX Corridors

Always-on settlement corridors between currency pairs. Real-time FX, no intermediaries, instant finality.

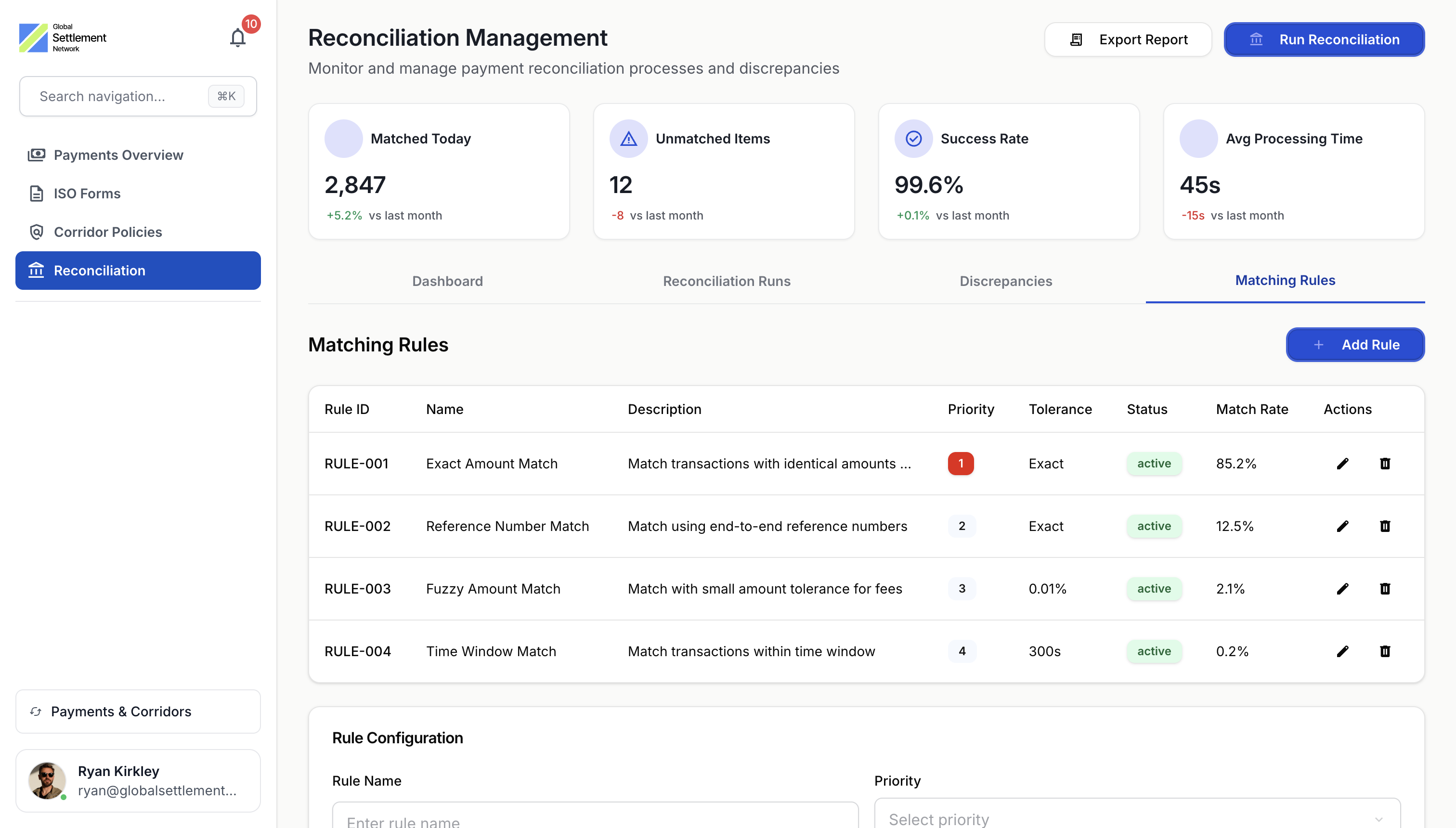

Real-Time Settlement

Move from T+2 to instant finality. Reduce counterparty risk and unlock trapped capital.

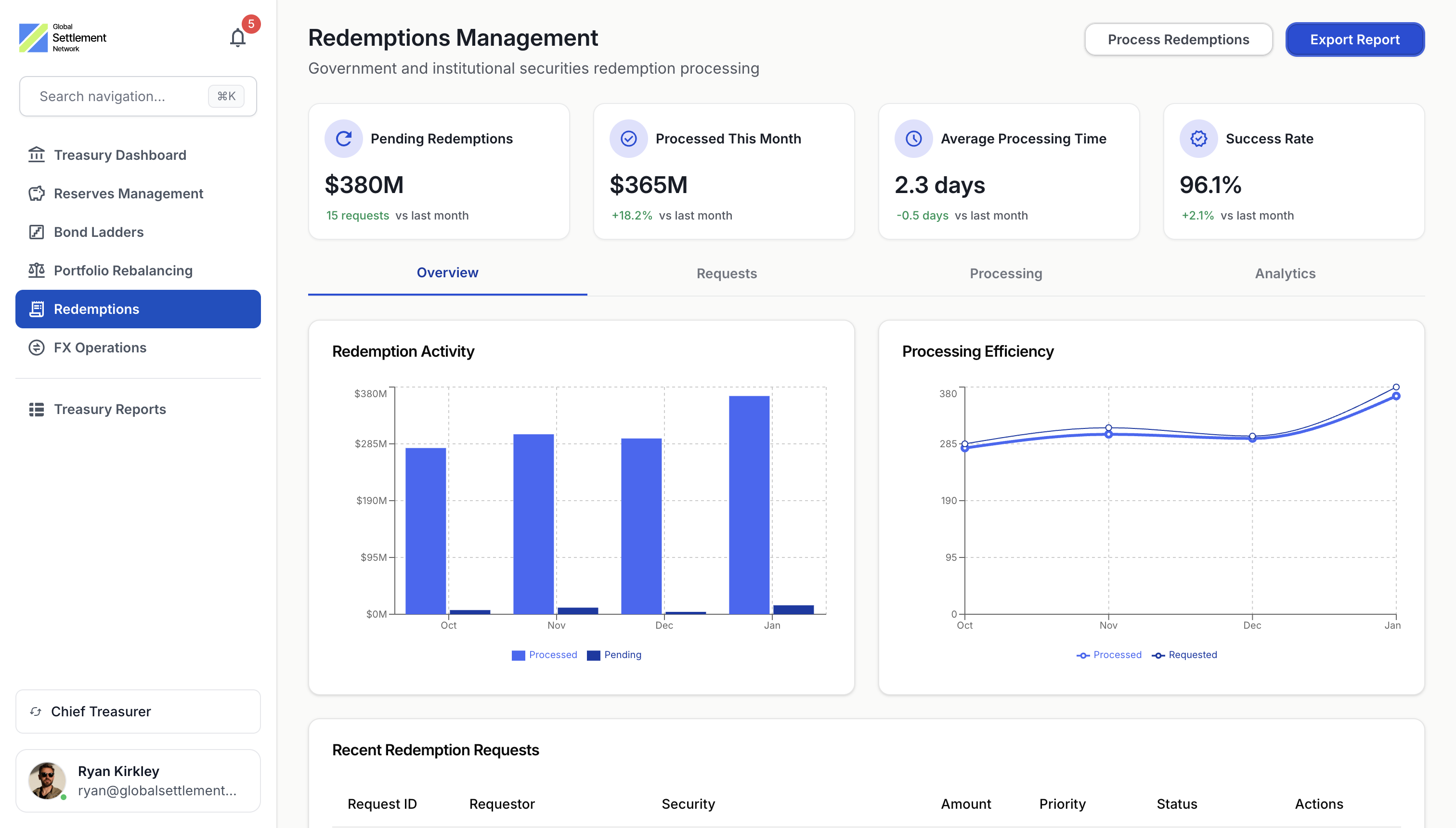

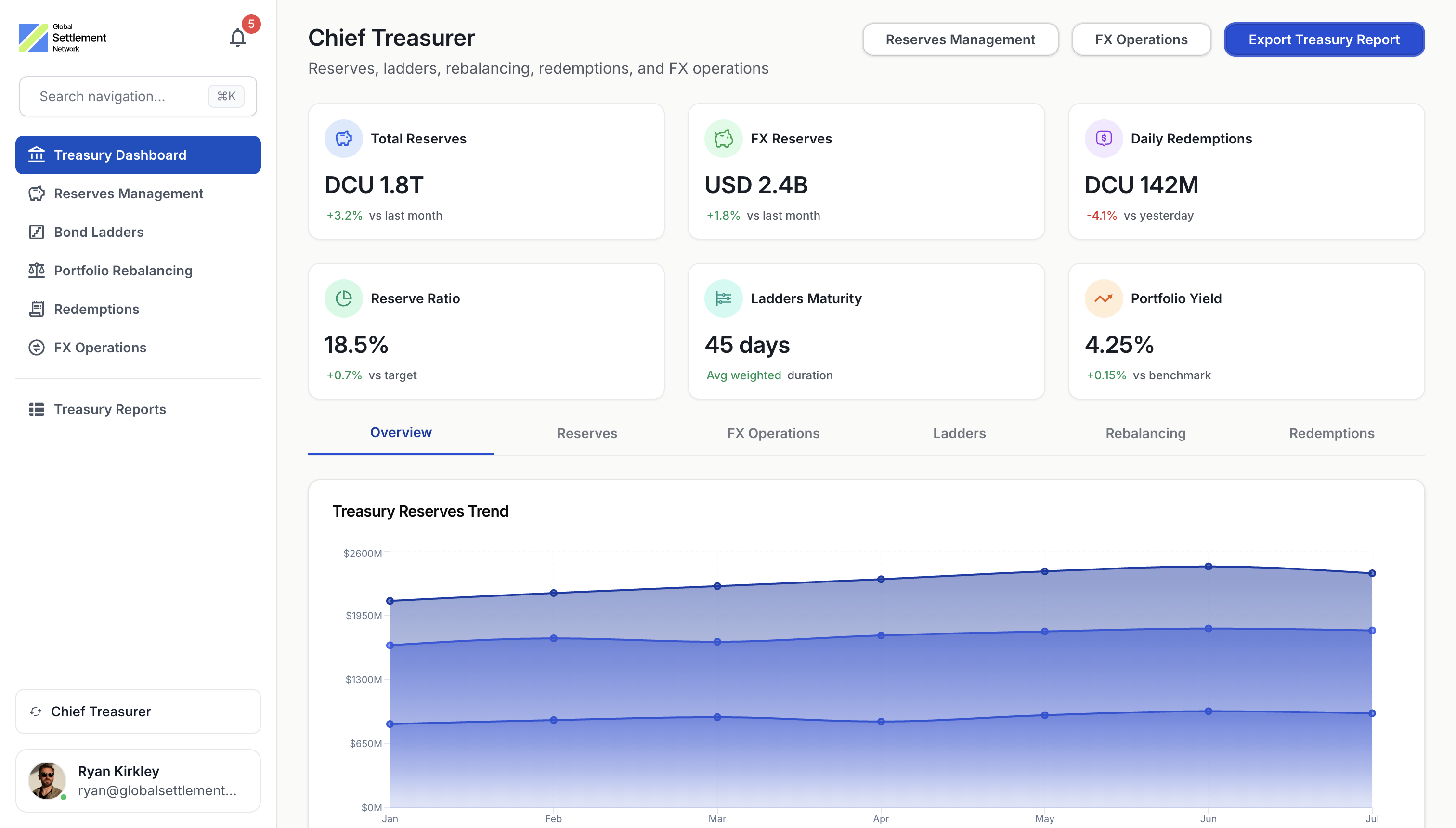

Treasury Optimization

Reduce nostro/vostro balances by 40-60%. Automated liquidity management and yield optimization.

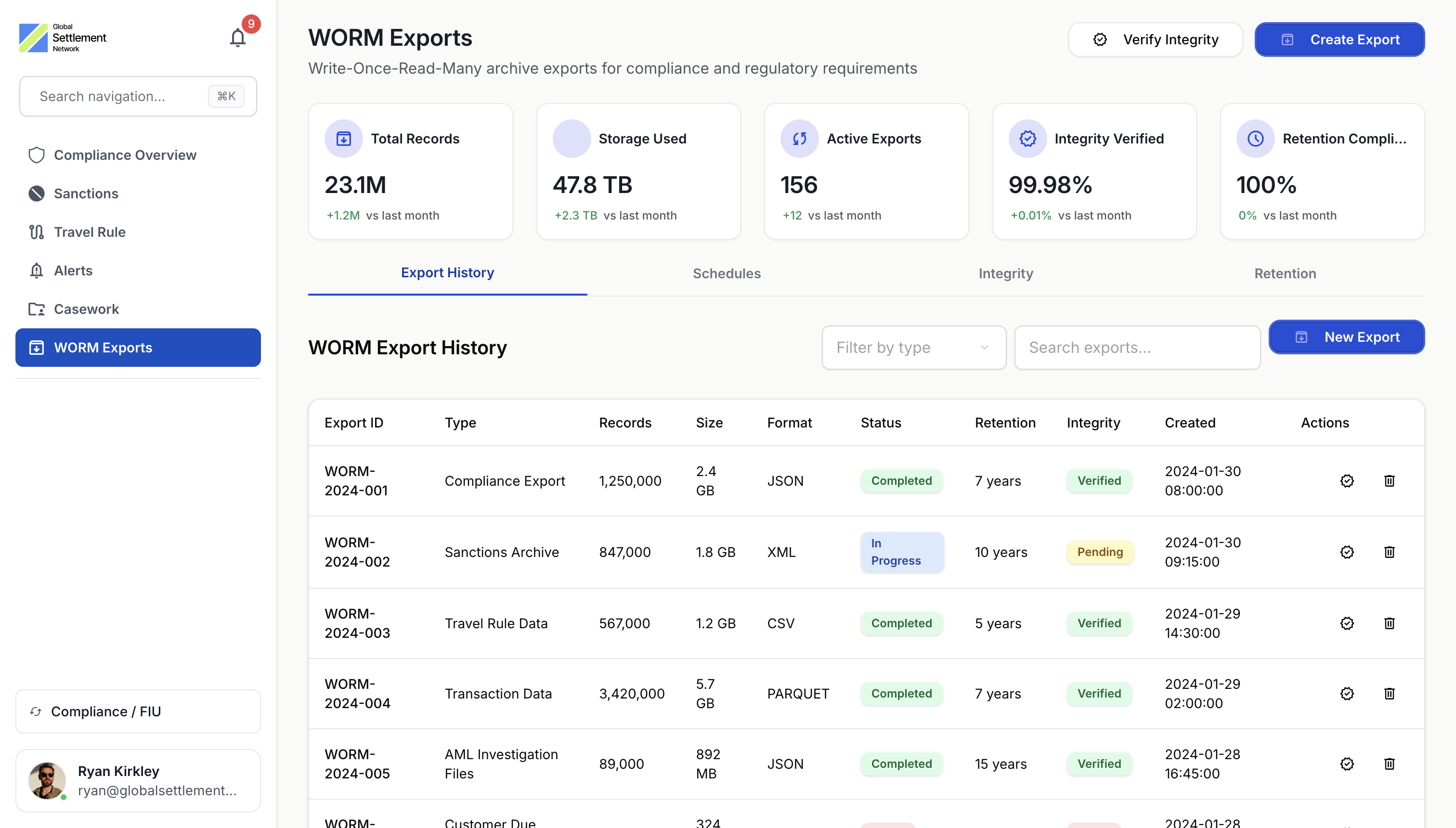

Compliance & AML

Built-in sanctions screening, transaction monitoring, and automated suspicious activity reporting.

Network Effects

Access liquidity across 6+ major banks, 3 governments, and 6 protocols on a shared network.

Core Banking Integration

SWIFT, ISO 20022, FIX protocol support. Seamless integration with existing systems.

COST REDUCTION

Dramatically lower cross-border costs

Designed to reduce correspondent banking fees, lower FX spreads, and minimize operational overhead.

70%

Lower Transaction Fees

Average reduction in cross-border payment costs

50%

Capital Efficiency

Reduction in nostro account balances required

24/7

Always Available

Settlement outside traditional banking hours

Reduce time, fees, and complexity in cross-border settlement

The current state

~8% fees

Sending $200 to Sub‑Saharan Africa costs ~8% on average and can take 3–14 business days.

Source: World Bank Remittance Prices Worldwide, Q3 2024

THE GLOBAL SETTLEMENT NETWORK APPROACH

Compress multi-party settlement chains

Global Settlement Network is built to compress multi‑party settlement chains and provide transparent, auditable flows for regulated participants.

Direct settlement paths

Designed to reduce reliance on intermediary banks and correspondent chains

Real-time visibility

Track settlement status, fees, and liquidity in real-time

Atomic settlement

Instant finality with cryptographic guarantees

How it works

Four steps to modern cross-border settlement

Initiate

Initiate payments via your existing systems or our API.

Verify

Real-time compliance and sanctions screening.

Settle

Instant FX with atomic settlement and near-instant finality.

Confirm

Funds delivered with a full audit trail.

ENTERPRISE SECURITY

Bank-grade security and compliance

Meet the highest standards for financial infrastructure with comprehensive security controls.

Designed for SOC 2 Type II: Security controls and processes aligned to audit standards

Multi-Sig Security: Distributed key management and hardware security modules

Regulatory Reporting: Automated generation of required compliance reports

Integrate without rewriting your stack.

STANDARDS ALIGNMENT

Banking standards & rails

Global Settlement Network is designed to align with banking standards and operational expectations, including messaging compatibility (e.g., ISO 20022 / SWIFT-style flows) and integration with domestic rails (ACH/Fedwire/FedNow where applicable).

POLICY FIREWALL

Transaction-layer compliance

The network enforces policy and compliance controls at the transaction layer via a rules-driven 'policy firewall,' including configurable checks for identity, sanctions screening, risk scoring, and Travel Rule interoperability where required.

Bank-grade operational controls

Multi-signature approvals, role-based access control, audit logging, and exception handling workflows built for regulated financial institutions.

Transform your cross-border operations

See how Global Settlement Network can modernize your correspondent banking and treasury operations.