<5s

Deterministic finality

View technical specs

Dual

Consensus mechanism (PoA+PoS)

Learn more

Zero

Bridge dependencies

See architecture

Why GSX for CBDCs

Built for central banks and financial institutions who demand enterprise-grade infrastructure with regulatory compliance at its core.

Compliance-first by design

Policy logic and KYC/AML are enforced before settlement. Attestations from permissioned Authority Nodes ensure transactions meet jurisdictional rules before PoS finalizes.

Finality and scale for FMI-grade workloads

Thousands of TPS targets with deterministic, BFT-style finality and 99.99% availability design goals, including failover and self-healing.

Interoperability without bridges

GSX natively writes settlement instructions to destination chains—no custodians, multisigs, or relayers; unified zk-proof audit trail.

How GSX Works

Explore the technical workflow that enables secure, compliant, and efficient cross-chain settlement without traditional bridge dependencies.

Lock/Burn on source

Initiate the transaction by locking or burning tokens on the source chain (e.g., domestic CBDC ledger). This ensures the total supply remains consistent across chains.

Compliance & Access (GSX PoA)

KYC, jurisdiction, and origin metadata are enforced through GSX's Proof of Authority consensus. Only authorized nodes can validate compliance requirements.

Proof generation (ZK)

Generate zero-knowledge proofs to validate transaction validity without exposing private data, ensuring privacy while maintaining regulatory compliance.

Finalization (GSX PoS)

ZK-augmented Byzantine Fault Tolerant finality through GSX's Proof of Stake consensus mechanism ensures deterministic settlement with cryptographic guarantees.

Native write to target chain

Mint or credit tokens directly on the destination chain without requiring bridges, custodians, or intermediaries. Direct settlement instructions are written natively.

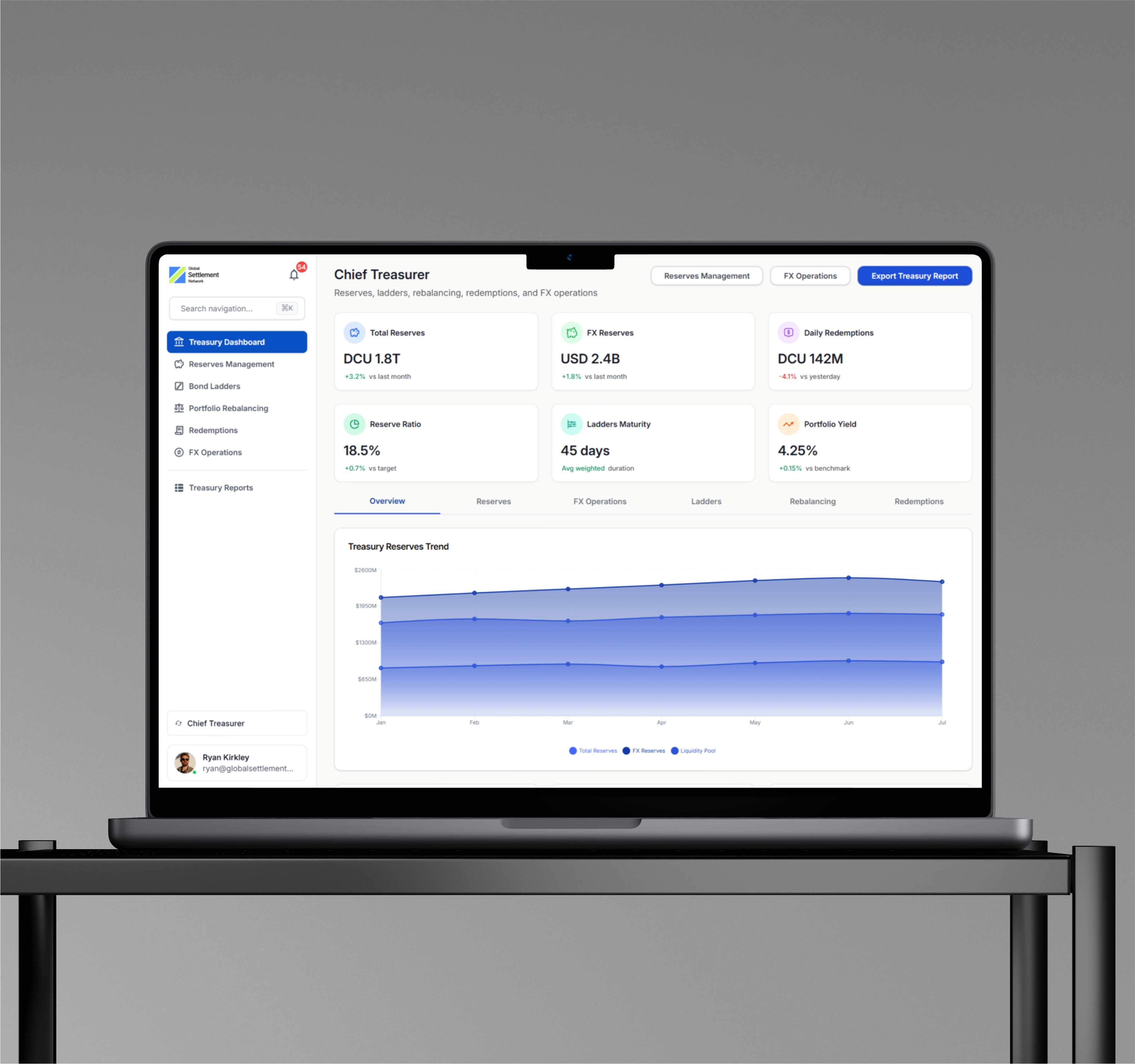

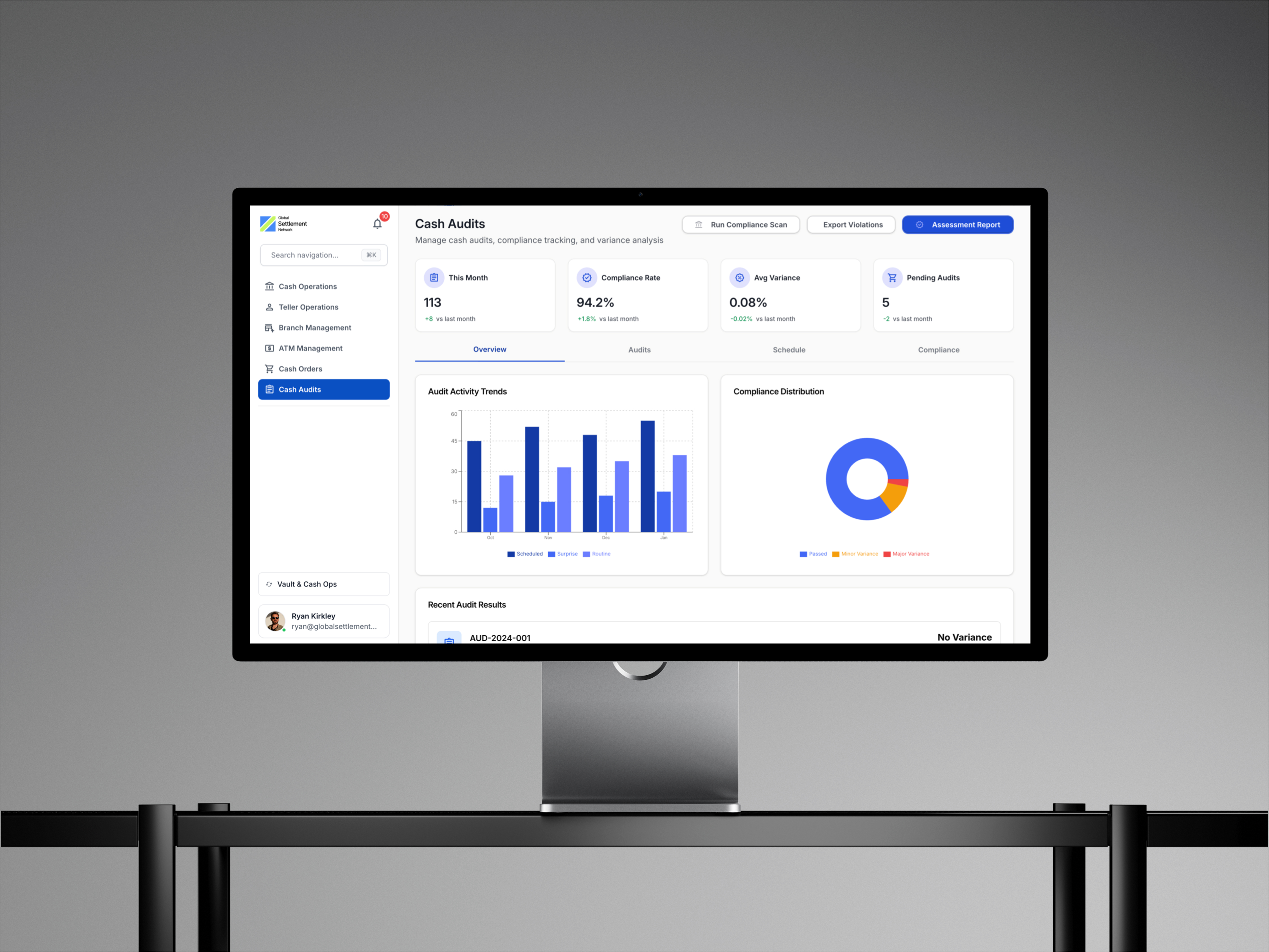

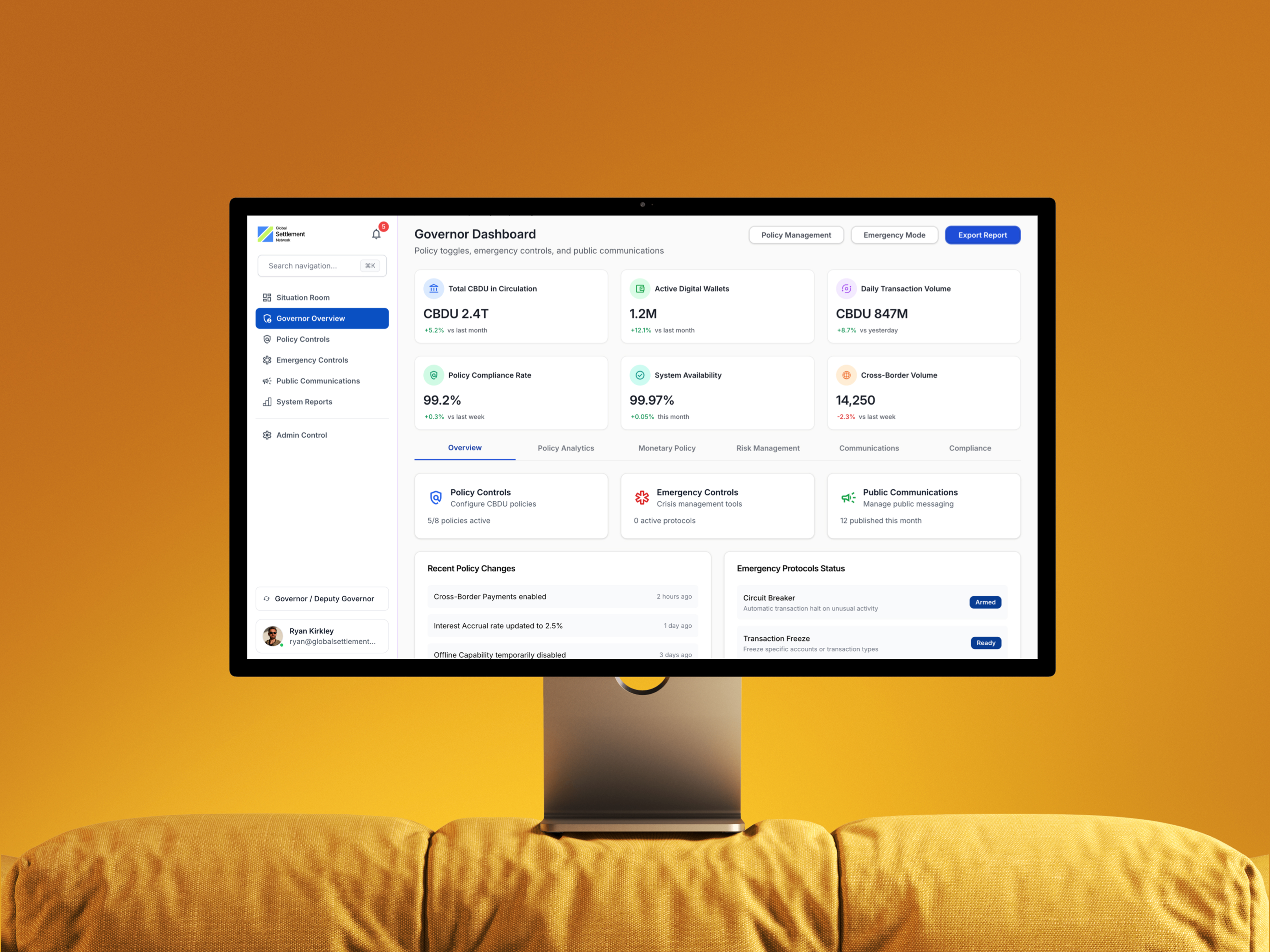

Admin & Sandbox

Experience GSX's compliance-first administration tools through our interactive demo environment.

Request Sandbox Access

Get hands-on access to GSX admin tools.

Qualified government and bank teams typically receive access within 24 hours.

Government rollout: a safe, phased path

A structured three-phase approach with clear exit criteria and regulator touchpoints for secure CBDC deployment.

Implementation Timeline

Phased deployment with clear milestones and exit criteria

1

Phase 1 — Sandbox/PoC

Months 0–6Issue test CBDC, basic PvP settlements, RTGS gateway stub integration, and compliance runbook development. Establish foundation for controlled testing environment.

2

Phase 2 — Limited live pilot

Months 6–24Deploy low-volume interbank and FX corridors with comprehensive SLA monitoring, regular stress testing drills, and formal legal opinion gathering.

3

Phase 3 — Production rollout

24+ monthsScale to broader participant network with 24/7 operational capabilities, formal rulebook implementation, and regular resilience exercises.

Key Benefits

Risk mitigation through gradual scaling

Continuous regulator engagement and feedback

Proven exit criteria for each phase

Implementation Checklist

Essential components for secure CBDC deployment

Policy controls

Transaction limits, jurisdiction rules, and compliance enforcement mechanisms

Audit trail

Comprehensive logging, immutable records, and regulatory reporting capabilities

Data localization options

Configurable data residency and cross-border data handling requirements

Rulebook & legal enforceability

Legal framework alignment and regulatory compliance documentation

SLA targets

Performance guarantees, uptime commitments, and operational excellence metrics

Bank integration blueprint

Enterprise-grade integration architecture with secure APIs, real-time events, and standards compliance.

Integration Architecture

Core banking system integration with GSX gateway

Core Banking

Legacy Systems

REST/gRPC API

GSX Gateway

API Layer

ISO 20022/SWIFT

Message Mapping

Protocol Adapter

Event Stream

Event Listeners

Real-time

Updates

Treasury

Position Mgmt

GL Entries

General Ledger

Accounting

Integration Flow

Secure, bi-directional communication with HSM-backed authentication and real-time event processing

GSX Transaction API Example

POST /v1/gsx/transactions

Content-Type: application/json

Authorization: Bearer eyJhbGciOiJSUzI1NiIsInR5cCI6IkpXVCJ9...

{

"transaction_id": "txn_2024_001_cbdc_001",

"source": {

"account": "central_bank_reserve_001",

"currency": "USD-CBDC",

"amount": "1000000.00"

},

"destination": {

"account": "commercial_bank_settlement_002",

"currency": "USD-CBDC",

"amount": "1000000.00"

},

"metadata": {

"iso20022_message_id": "PACS.008.001.10",

"instruction_reference": "INST20240115001",

"settlement_method": "CLGS",

"priority": "HIGH",

"regulatory_reporting": {

"jurisdiction": "US",

"reporting_party": "FED_NY_001"

}

},

"compliance": {

"kyc_verified": true,

"aml_cleared": true,

"sanctions_checked": true,

"policy_attestation": "PoA_NODE_001_SIGNATURE"

},

"signature": "MEUCIQDxxxxxxxxxxxxx...REDACTED...xxxxxxxxxxxxx"

}Sensitive Data

JSON Schema

HSM Signed

Integration Features

Enterprise-ready capabilities for secure bank connectivity

HSM-backed keys

Hardware security modules ensure cryptographic key protection and transaction signing

Webhook events

Real-time notifications for transaction status, settlements, and compliance updates

Message bus integration

Enterprise message queue compatibility for reliable, asynchronous processing

ISO mapping adapters

Seamless translation between ISO 20022, SWIFT MT, and proprietary bank formats

Security & Compliance

All communications are encrypted end-to-end with HSM-backed digital signatures. Full audit trails and regulatory reporting ensure compliance with local and international banking standards.

Security & performance

Enterprise-grade performance metrics with deterministic finality, proven availability, and elastic scaling capabilities.

Deterministic finality (BFT): seconds

Byzantine fault tolerant consensus ensures immediate, irreversible transaction finality without probabilistic confirmation delays.

High availability target 99.99%

Redundant nodes with automatic failover and geographic distribution ensure continuous operation with minimal downtime.

Elastic scaling; stress-tested to 10× bursts

Dynamic throughput scaling handles traffic spikes and market volatility with proven resilience under extreme load conditions.

Dual consensus: PoA (policy) + PoS (finality)

Proof of Authority enforces compliance and regulatory policy while Proof of Stake provides decentralized economic finality.

Performance & Availability Citations

Performance: Deterministic BFT finality with 2-3 second block times and <5s P95 SLA targets.Availability: 99.99% uptime through redundant validator distribution and automated failover.Scaling: Elastic throughput from 2,000+ TPS base to 10× burst capacity under stress testing.Consensus: Hybrid PoA/PoS architecture separating policy enforcement from economic finality.

Technical Specifications

Detailed performance metrics and system architecture

Governance & compliance

Public‑permissioned governance for FMIs: a Council of reputable institutions with on‑chain voting for upgrades; central banks hold meaningful sway on systemic matters.

2-Tier Governance Model

Supervisory oversight with decentralized execution

Supervisory Layer (PoA)

Policy Enforcement & Compliance

Council Governance

Reputable institutions with on-chain voting rights

Central Bank Authority

Meaningful influence on systemic policy matters

Compliance Enforcement

KYC/AML and jurisdictional rule validation

Emergency Powers

Reversible measures under strict legal conditions

Governance Flow

Policy decisions → Network execution

Main Chain (PoS)

Decentralized Settlement & Finality

Economic Consensus

Stake-weighted validation and block production

Immutable Settlement

Cryptographic finality without governance override

Network Operations

Validator set, staking rewards, and slashing

Protocol Upgrades

Technical improvements via Council approval

Policy parameters

Compliance rules

Emergency procedures

Validator criteria

Protocol upgrades

Transaction finality

Cryptographic proofs

Settlement mechanics

Core consensus

Stake slashing

Governance Separation

Policy decisions are made by institutional governance while settlement finality remains cryptographically immutable and economically secured.

Governance Framework

Professional oversight and legal certainty for institutional confidence

Advisory Board for Public Sector

Senior experts from central banking, financial regulation, and international monetary policy providing strategic guidance on CBDC implementation and cross-border coordination.

Emergency Measures Framework

Reversible emergency powers exercised only under strict legal conditions with mandatory judicial review and automatic sunset clauses to prevent abuse.

Rulebook Under Neutral Law

Established legal frameworks providing regulatory certainty

New York Law

Neutral LawEstablished commercial law precedents

Strong contract enforcement mechanisms

International arbitration compatibility

Regulatory clarity for financial institutions

Cross-border dispute resolution frameworks

English Law

Neutral LawMature common law system

International financial services expertise

Sophisticated regulatory architecture

Global arbitration center recognition

Fintech-friendly legal innovations

Legal Safeguards & Accountability

All governance actions are subject to established legal frameworks with clear appeal processes, mandatory transparency requirements, and institutional accountability mechanisms to ensure responsible exercise of emergency powers.

Policy Trust Framework

Institutional Confidence

GSX combines institutional oversight with cryptographic immutability, ensuring that policy decisions are made by qualified authorities while settlement mechanics remain tamper-proof. This dual-layer approach provides the regulatory certainty that central banks require while maintaining the technical integrity that makes blockchain settlement reliable.

Democratic Governance

Council voting ensures no single institution controls network policy, while central bank authority addresses systemic risk concerns.

Immutable Settlement

Once transactions achieve cryptographic finality, they cannot be reversed through governance, ensuring settlement certainty for all participants.

Case studies & scenarios

Real-world implementation scenarios demonstrating GSX's capabilities for central banks and financial institutions.

National CBDC on GSX

Cross-border Settlement

eNaira ↔ SGD corridor concept demonstrating PvP/FX rules and token policy carried cross‑border with native interoperability.

Real-time PvP settlement between central banks

Cross-border FX rules enforcement

Token policy portability across jurisdictions

Native write to destination chains

Regulatory compliance automation

Private Bank Tokenization & DvP

Instant Settlement

Atomic delivery vs payment on a single ledger enabling instant settlement for tokenized assets and securities.

Atomic DvP settlement mechanics

Single ledger for all participants

Instant finality for tokenized assets

Programmable settlement conditions

Reduced counterparty risk

Government Outcomes

Measurable benefits for central banks and financial institutions

Cost Savings

Improvement

60-80%

Reduction in cross-border settlement costs compared to traditional correspondent banking networks

Financial Inclusion

Improvement

2.5B+

Unbanked and underbanked populations gaining access to digital financial services

Transparency

Improvement

100%

Real-time visibility into transaction flows and settlement status for regulatory oversight

FX Liquidity

Improvement

24/7

Continuous foreign exchange markets with instant settlement and reduced counterparty risk

Asset Tokenization

Improvement

Trillions

New asset classes and investment opportunities through programmable digital assets

Regulatory Compliance

Improvement

Real-time

Automated compliance monitoring and reporting across multiple jurisdictions

Detailed Analysis Available

Comprehensive impact studies and ROI calculations available in our CBDC White Paper and GSX GOV 6-pagerfor government stakeholders and policy makers.

Detailed Documentation

Available for Government Stakeholders

Comprehensive analysis and implementation guides available under NDA for qualified government institutions and central banks evaluating CBDC deployment.

CBDC White Paper

Technical specifications and policy framework

GSX GOV 6-pager

Executive summary for decision makers

FAQs

Common questions about GSX CBDC implementation, technical architecture, and regulatory compliance.

Frequently Asked Questions

Common questions about GSX CBDC implementation

Have More Questions?

Technical & Policy Support

Our technical and policy teams are available to address specific questions about GSX implementation, regulatory compliance, and integration requirements for your institution.

Central Bank Support

Policy and regulatory guidance

Technical Integration

Implementation and architecture